2016 FHA Loan Requirements

2016 FHA Loan Requirements · First Time Home Buyer Florida · About Us

FHA after bankruptcy FHA after foreclosure FHA after short sale

FHA new updated guidelines an acceptable payment history if the Borrower has made all housing and installment debt payments on time for the previous 12 months and no more than two 30-day late mortgage or installment payments in the previous 24 months.

Deferred Obligations refer to liabilities that have been incurred but where payment is deferred or has not yet commenced, including accounts in forbearance.

The lender must include deferred obligations in the Borrower’s liabilities.

The lender must obtain written documentation of the deferral of the liability from the creditor and evidence of the outstanding balance and terms of the deferred liability. The lender must obtain evidence of the anticipated monthly payment obligation, if available.

The lender must use the actual monthly payment to be paid on a deferred liability, whenever available. If the actual monthly payment is not available for installment debt, the lender must utilize the terms of the debt or 5 percent of the outstanding balance to establish the monthly payment.

For a student loan, if the actual monthly payment is zero or is not available, the lender must utilize 2 percent of the outstanding balance to establish the monthly payment.

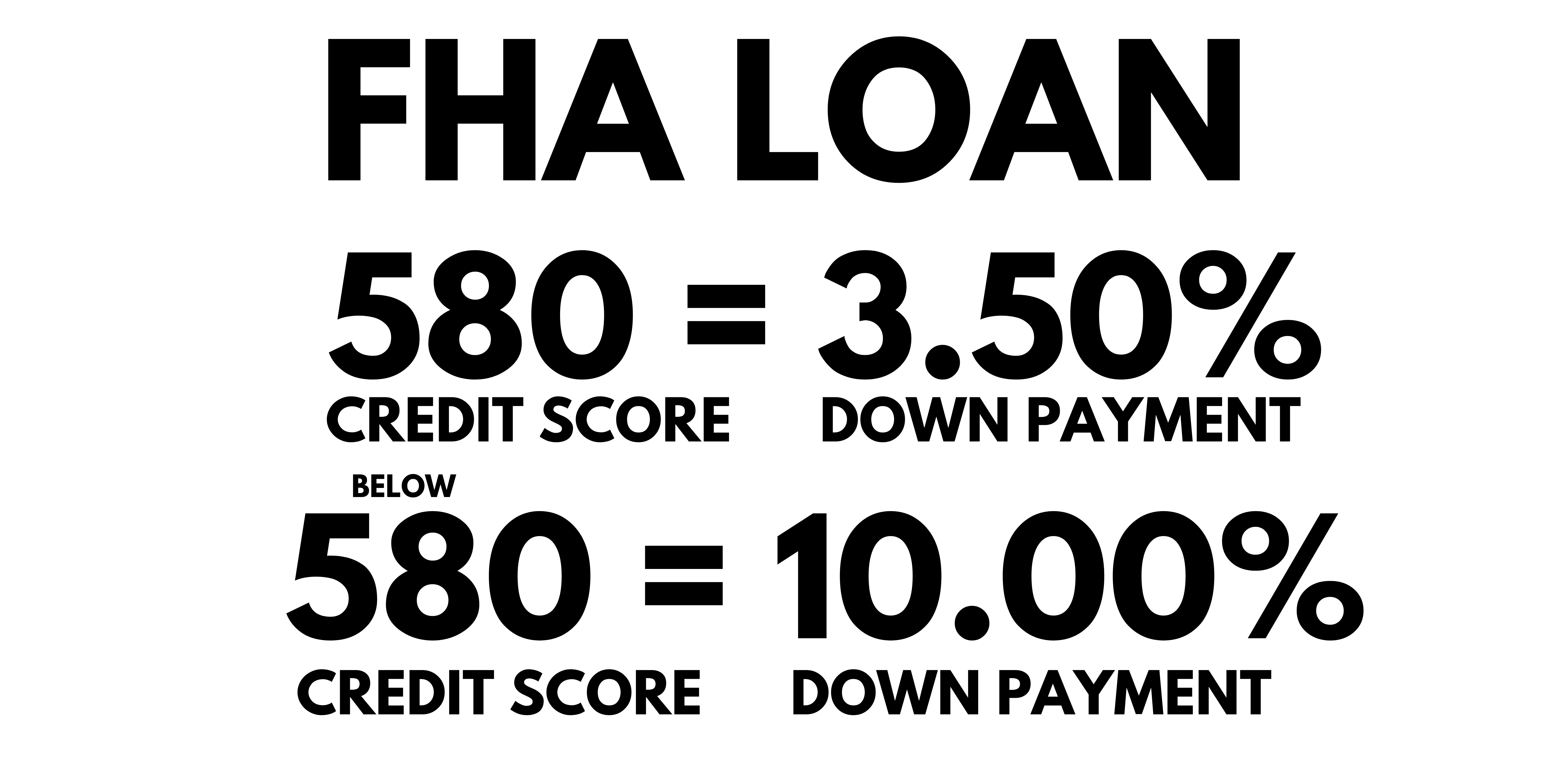

Credit score - FHA announced a new policy to address risk. FHA changed the minimum credit score for new borrowers.

- FHA requirements new borrowers will now be required to have a

minimum credit score of 580 to qualify for 3.5% down payment

- FHA loan requirements new borrowers with less than a 580 credit score will be required to put down at least 10%

This has allowed the FHA to better balance its risk and continue to provide financing for home buyers.

Debt-to-income ratio - FHA loan requirements include a maximum debt to income ratio. When a borrower applies for an FHA mortgage, they are required to disclose all debts, open lines of credit, and all possible approved sources of regular income. Using this data, the lender and FHA can calculate the borrower's debt-to-income ratio.

- Most lenders will limit maximum debt-to-income to under 50%

- FHA maximum debt to income ratio is 54.99%

- Manual underwriting maximum

debt to income ratio is 43%

2016 FHA Loan Requirements

Call us 888.958.5382

FHA purchase FHA refinance FHA 203k loan FHA cash out $100 down loan

FHA loan requirements - FHA loan limits - FHA loans - FHA Streamline

Mortgage World Home Loans of New Jersey is a licensed residential mortgage broker in the state of Florida and will match you with the lender that will approve your FHA loan down to a 500 credit score.

We look forward to working with you.

Call us 888-958-5382

www.MORTGAGE-WORLD.com LLC is an online mortgage company specializing in FHA loans for first time home buyers.

We look forward to working with you.

2016 FHA Loan Requirements

Recent Articles

-

Low Credit Score Mortgage Florida

Apr 04, 24 09:41 AM

Low Credit Score Mortgage Florida Down to 500. Purchase or Refinance. -

Credit Score Requirements for FHA 2024

Mar 18, 24 09:08 AM

Credit Score Requirements for FHA 2024. For individuals applying for an FHA loan, it's important to note that there is a minimum FICO score requirement of 500. -

FHA Loan Requirements 2024 - FHA Loan Programs 2024

Mar 15, 24 01:12 PM

FHA loan requirements 2024. FHA loan guidelines for minimum credit score, minimum down payment and closing costs.

Call Now, Our Staff is Available!

800.516.9166

What's the minimum credit score needed to buy a house or refinance in Florida?

Call 888.958.5382

FHA loans

FHA loans require a minimum 500 credit score to buy a house or refinance

VA

Requires a minimum credit score of 500 to buy a home

Fannie Mae

Requires a minimum credit score of 620 to buy a home

Call Now, Our Staff is Available

888-958-5382