FHA Mortgage Guidelines 2016

FHA Mortgage Guidelines 2016 - Borrowers with a prior bankruptcy, foreclosure, deed-in-lieu, or short sale may be eligible for an FHA insured loan if the bankruptcy, foreclosure, deed-in-lieu, short sale was the result of a documented extenuating circumstance.

Borrowers may also be eligible for an FHA insured loan on a purchase transaction after 12 months from the completion, discharge, trustee's sale if the borrower meets the requirements for extenuating circumstances Economic Event.

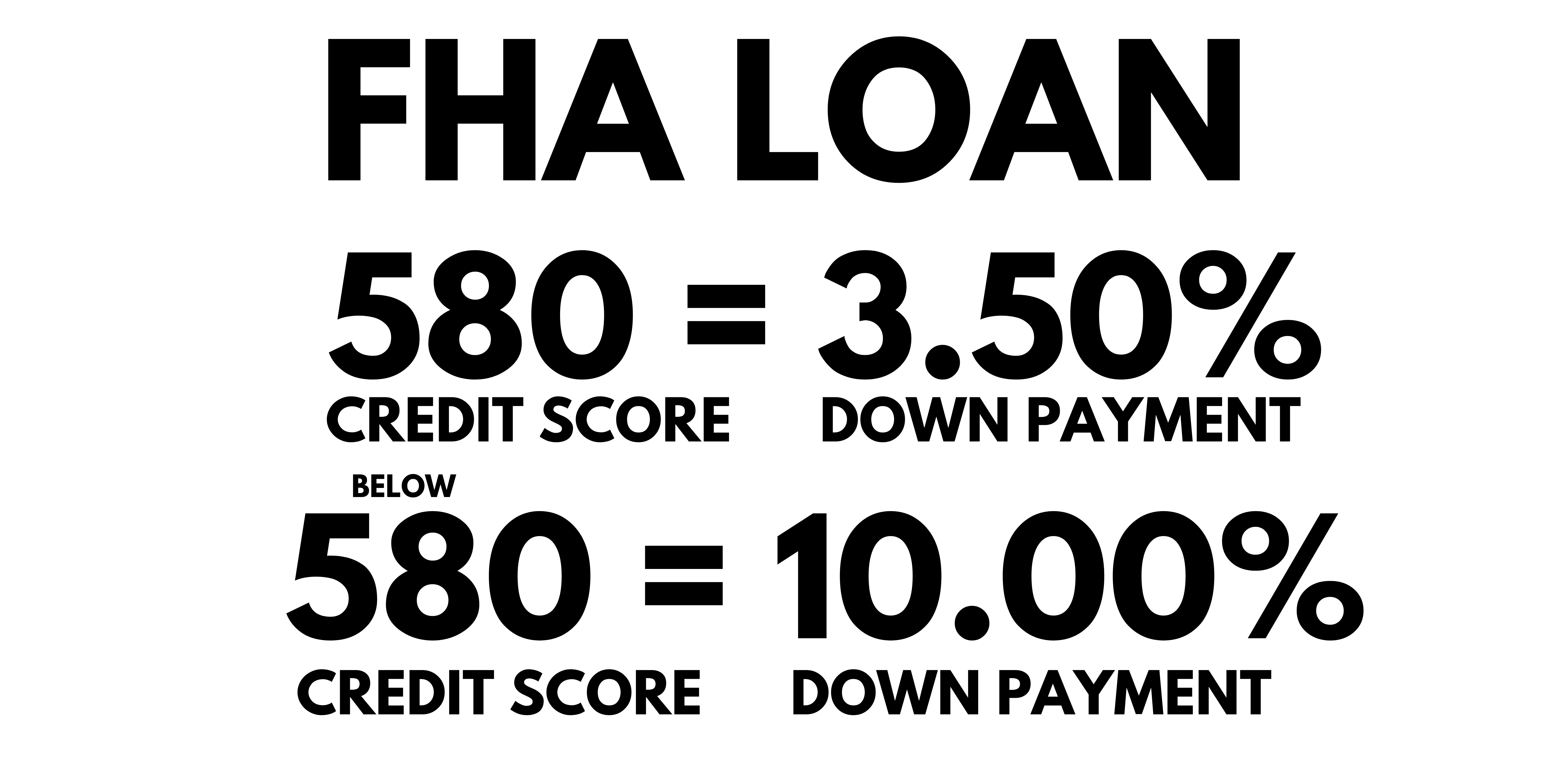

FHA minimum credit score

FHA allows a home

buyer to make a down payment of 3.50% and allows the seller to contribute up to

6% of the purchase price for closing costs

with a 580 minimum credit score.

First time home buyers with a credit score below 580 must make a minimum 10.0% down payment and allows a seller concession of up to 6% of the purchase price to pay for closing cost.

FHA requires a minimum credit score of 500 to qualify for a home buyer loan.

- Minimum 580 credit score 3.5% down payment

- Below 580 credit score 10% down payment

- There are no trade line requirements

- Collection accounts do not have to be paid off

- Any disputed accounts must be resolved

Chapter 7 Bankruptcy

At least two years must have elapsed since the discharge date of the borrower and / or spouse's Chapter 7 Bankruptcy, according to FHA guidelines.

Chapter 13 Bankruptcy

FHA will consider approving a borrower who is still paying on a Chapter 13 Bankruptcy if those payments have been satisfactorily made and verified for a period of one year. The court trustee's written approval will also be needed in order to proceed with the loan.

Foreclosure

Foreclosure must have been resolved for at least 3 years with no late payments since the date of resolution. Minimum credit score of 500.

Seasoning Requirements are determined by the type of loan:

- Government loan: seasoning is determined by the date the claim was paid

- Loans other than Government: seasoning is determined by the date of sale the lender sold the property

Short Sale

FHA requires a minimum of three years from the date of sale. FHA guidelines requires three year past from the date of sale of the property. Documentation of sale date will be required.

Call us 888.958.5382

FHA purchase FHA refinance FHA 203k loan FHA cash out $100 down loan

FHA loan requirements - FHA loan limits - FHA loans - FHA Streamline

Mortgage World Home Loans is

an online mortgage company specializing in FHA loans for first time

home buyers. To buy a house with 3.5% down payment and a minimum

credit score of 580 using an FHA loan, apply online.

We look forward to working with you.

Call us 888-958-5382

www.MORTGAGE-WORLD.com LLC is an online mortgage company specializing in FHA loans for first time home buyers.

We look forward to working with you.

FHA mortgage guidelines 2016, FHA mortgage guidelines 2016 Florida

FHA Minimum Credit Score Needed to Buy a House

FHA

Requires a minimum credit score of 500 to buy a home

VA

Requires a minimum credit score of 500 to buy a home

Fannie Mae

Requires a minimum credit score of 620 to buy a home

Freddie Mac

Requires a minimum credit score of 620 to buy a home

Call Now, Our Staff is Available

888-958-5382

Recent Articles

-

Low Credit Score Mortgage Florida

Apr 04, 24 09:41 AM

Low Credit Score Mortgage Florida Down to 500. Purchase or Refinance. -

Credit Score Requirements for FHA 2024

Mar 18, 24 09:08 AM

Credit Score Requirements for FHA 2024. For individuals applying for an FHA loan, it's important to note that there is a minimum FICO score requirement of 500. -

FHA Loan Requirements 2024 - FHA Loan Programs 2024

Mar 15, 24 01:12 PM

FHA loan requirements 2024. FHA loan guidelines for minimum credit score, minimum down payment and closing costs.

Call Now, Our Staff is Available!

800.516.9166