Florida minimum credit score

Florida minimum credit score to buy a home or refinance is 500 for an FHA loan. Updated FHA policy requires a minimum credit score of 500 to buy a house. Borrowers with a credit score above 500 are eligible for an FHA loan.

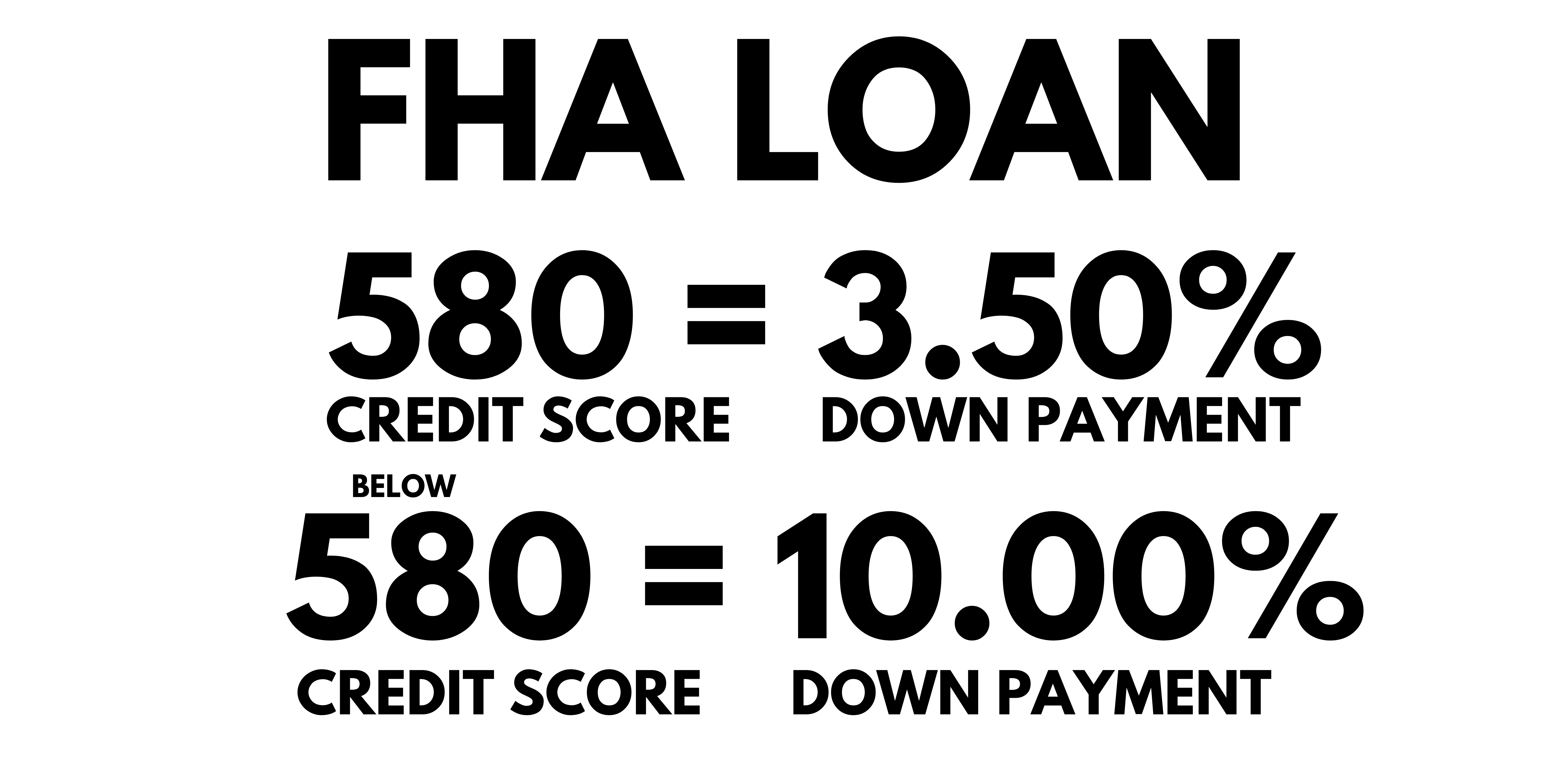

New borrowers will now be required to have a minimum credit score of 580 to qualify for FHA 3.5% down payment. New borrowers with less than a 580 credit score will be required to put at least 10% down payment.

FHA has taken the following step:

- Florida minimum credit score to buy a house possible FHA loan

- FHA has updated the combination of credit score and down payments for new borrowers

- You will now need a minimum credit score of 580 to qualify for FHA's 3.5% down payment program

- If you have less than a 580 credit score you will need 10% down payment for an FHA loan

Closing cost - FHA allows the seller to pay up to 6% of your closing cost.

If you are buying a $100,000.00 house FHA allows the seller to pay up to $6,000.00 for your closing cost. It must be in writing in the sales contract, "Seller will pay up to 6% of buyer's closing cost."

If you do not write it into the sales contract then you will be paying the closing cost. In the state of Florida closing cost for a $100,000.00 house average around $4,300.00 depending on taxes, insurance and who's paying the transfer tax and owner's title insurance.

By allowing the seller to pay for your closing cost you will decrease the amount of money required to buy a home. Buying a $100,000.00 property requires $3,500.00 down payment and if the seller pays up to $6,000.00 for your closing cost you will only need around $4,000.00 to buy a $100,000.00 in Florida.

FHA Back to Work Program - New borrowers may also be eligible for an FHA insured loan on a purchase transaction after 12 months from the completion, discharge, trustee's sale if the borrower meets the requirements for extenuating circumstances Economic Event.

Borrowers with a prior bankruptcy, foreclosure, deed-in-lieu, or short sale may be eligible for an FHA insured loan if the bankruptcy, foreclosure, deed-in-lieu, short sale was the result of a documented extenuating circumstance.

Collection accounts - New the FHA does not require collection accounts to be paid off as a condition of mortgage approval. However, FHA does recognize that collection efforts by the creditor for unpaid collections could affect the borrower’s ability to repay the mortgage.

- If evidence of a payment arrangement is not available, the lender must calculate the monthly payment using 5% of the outstanding balance of each collection, and include the monthly payment in the borrower’s debt-to-income ratio

Debt-to-income ratio - FHA loan loan requirements include a maximum debt to income ratio. When a borrower applies for an FHA mortgage, they are required to disclose all debts, open lines of credit, and all possible approved sources of regular income. Using this data, the lender and FHA can calculate the borrower's debt-to-income ratio.

- Most lenders will limit maximum debt-to-income to under 50%

- FHA maximum debt to income ratio is 54.99%

- Manual underwriting maximum debt to income ratio is 43%

Florida minimum credit score to refinance

Rate and Term Refinance

This is the lowest rate in over 50 years according to Freddie Mac. FHA has more flexible underwriting guidelines compare to conventional loans.

FHA streamline provides a way for current FHA homeowners to lower their interest rate with little or no out-of-pocket costs. These loans can also be made faster and with less documentation than a typical loan. "No Cost" Streamlines let you refinance your mortgage with no out-of-pocket expenses.

Cash Out Refinance

Cash out refinance refinance allows homeowners to refinance their existing mortgage by taking out another mortgage for more than they currently owe, therefore repaying their current mortgage and using the equity they have built up in their home to take out another larger mortgage.

FHA refinance allows cash out amount up to 85% of the value of the property.

Florida minimum credit score for FHA loans is 500.

Florida minimum credit score

Call us 888.958.5382

We recognize the importance to you of keeping your information secure and confidential. We will not sell or share your personal information.

Call us 888-958-5382

www.MORTGAGE-WORLD.com LLC is an online mortgage company specializing in FHA loans for first time home buyers.

We look forward to working with you.

Florida minimum credit score needed to purchase a home

Call 888.958.5382

Recent Articles

-

Low Credit Score Mortgage Florida

Apr 04, 24 09:41 AM

Low Credit Score Mortgage Florida Down to 500. Purchase or Refinance. -

Credit Score Requirements for FHA 2024

Mar 18, 24 09:08 AM

Credit Score Requirements for FHA 2024. For individuals applying for an FHA loan, it's important to note that there is a minimum FICO score requirement of 500. -

FHA Loan Requirements 2024 - FHA Loan Programs 2024

Mar 15, 24 01:12 PM

FHA loan requirements 2024. FHA loan guidelines for minimum credit score, minimum down payment and closing costs.

Call Now, Our Staff is Available!

800.516.9166

FHA loan

Requires a minimum credit score of 500 to buy a home with a low down payment

VA loan

Requires a minimum credit score of 500 to buy a home with zero down payment

Fannie Mae

Requires a minimum credit score of 620 to buy a home with a low down payment

Freddie Mac

Requires a minimum credit score of 620 to buy a home

with a low down payment

Call Now, Our Staff is Available

888-958-5382