Kissimmee FHA Loans

Kissimmee FHA loans maximum loan limits is $331,760 for owner occupied single family homes, PUD's, condominium projects, land contracts and manufactured homes (minimum doublewide).

Kissimmee FHA loans have been helping people become homeowners since 1934. A perfect credit score is not needed for an FHA loan approval. In fact, even if you have had credit problems, such as a bankruptcy, it's easier for you to get an FHA loan than a conventional loan.

FHA announced a set of policy changes

to strengthen the FHA. The changes announced are the latest in a series

of changes enacted in order to better position the FHA to manage its

risk while continuing to support the nation’s housing market recovery.

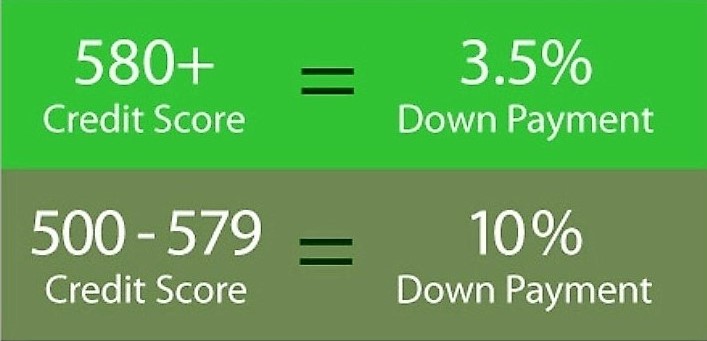

FHA requires a minimum credit score of 500. There are no income limits like you may find with first time home buyer programs. However, there are limits on how much you can borrow.

- 203(b) FHA purchase program provides mortgages for home buyers to purchase a principal residence with a low down payment and with lower credit standards.

- 203(k) FHA purchase program is for the rehabilitation and repair of single family properties. Providing both the financing to purchase a property and the financing to make repair. The program offers an important tool for expanding home ownership opportunities.

- HUD $100 down payment program for borrowers purchasing single-family HUD Real Estate Owned (REO). The program is limited to owner-occupant buyers who have not purchased a HUD REO property within the last 24 months.

- Lease with option to buy mortgage. Lease

with option to buy allows a renter to buy the property they are renting.

A lease option mortgage allows for sellers credit.

- Gift of equity mortgage loan. A gift of equity is a transfer of ownership of a property to a family member or someone. Gift of equity down payment and gift funds requirements.

Kissimmee FHA allows a home buyer to make a down payment of 3.50% and a seller contribution of up to 6% for closing costs with only a 580 minimum credit score. First time home buyer with credit scores below 580 must make a minimum 10.0% down payment of the purchase price and a seller concession of up to 6% to pay for closing cost is allowed.

Kissimmee FHA requires a minimum down payment of 3.50% of the purchase price. The funds may be the borrower's own funds, a gift from a family member, rent credit or borrowed. FHA regulates some of the closing costs associated with a FHA loan.

Osceola County 2020 FHA loan limits.

Call us 888-958-5382

www.MORTGAGE-WORLD.com LLC is an online mortgage company specializing in FHA loans for first time home buyers.

Apply Now!

Call us 305-748-3007

|

www.MORTGAGE-WORLD.com, LLC is a online mortgage company specializing in FHA loans for borrowers with less than perfect credit. |

www.MORTGAGE-WORLD.com, LLC es una compañía hipotecaria en línea especializada en préstamos FHA para prestatarios con un crédito menos que perfecto. |

Recent Articles

-

Mortgage Rates August 5

Aug 05, 24 04:10 PM

Mortgage Rates August 5, 2024. Rates have gone down recently. Lower rates equals lower mortgage payment. -

Mortgage Rates August 5 2024

Aug 05, 24 03:55 PM

Mortgage Rates August 5 2024 -

Today's FHA Rates 5.00% & 5.875% Conventional Minimum 700 Credit Score

Aug 05, 24 03:48 PM

Today’s historically low 30 year fixed interest rates make now the perfect time to purchase a new home or refinance To be approved at the lowest mortgage rates, you do not need to have the highest cre…

Call Now, Our Staff is Available!

800.516.9166

Recent Articles

-

Mortgage Rates August 5

Aug 05, 24 04:10 PM

Mortgage Rates August 5, 2024. Rates have gone down recently. Lower rates equals lower mortgage payment. -

Mortgage Rates August 5 2024

Aug 05, 24 03:55 PM

Mortgage Rates August 5 2024 -

Today's FHA Rates 5.00% & 5.875% Conventional Minimum 700 Credit Score

Aug 05, 24 03:48 PM

Today’s historically low 30 year fixed interest rates make now the perfect time to purchase a new home or refinance To be approved at the lowest mortgage rates, you do not need to have the highest cre…