203k Mortgages: The Ultimate Guide

Are you looking for a way to finance your dream home while also covering the costs of renovations and repairs? If so, a 203k mortgage may be the solution you've been searching for. These loans allow you to purchase or refinance a home while also receiving funds for eligible repairs and renovations.

In this guide, we'll cover everything you need to know about 203k mortgages, including eligibility requirements, benefits, and drawbacks. Whether you're a first-time homebuyer, a seasoned investor, or simply looking to upgrade your current home, our comprehensive guide will provide you with the knowledge you need to make an informed decision.

What is a 203k Mortgage?

A 203k mortgage is a type of mortgage that allows you to finance the purchase or refinance of a home while also receiving funds for eligible repairs and renovations. These loans are backed by the Federal Housing Administration (FHA) and are designed to help individuals and families purchase homes that need repair or renovation.

Eligibility Requirements

To qualify for a 203k mortgage, you'll typically need to meet certain eligibility requirements. These may include:

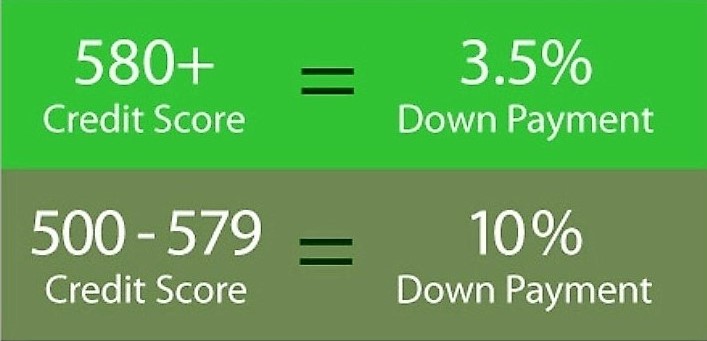

- A minimum credit score of 580 or higher

- A down payment of at least 3.5%

- Proof of income and employment

- The property must meet certain eligibility requirements and be your primary residence

Benefits of 203k Mortgages

There are many benefits to 203k mortgages, including:

- Ability to finance both the purchase and renovation of a home in one loan

- Lower down payment requirements compared to traditional mortgages

- The ability to borrow up to 110% of the home's value for renovations and repairs

- FHA backing, which may make it easier to qualify for a loan

Drawbacks of 203k Mortgages

While 203k mortgages offer many benefits, there are also some drawbacks to consider. These may include:

- Strict eligibility requirements, including the property must be your primary residence

- Higher interest rates and fees compared to traditional mortgages

- The need to work with a consultant to oversee the renovation process

- More paperwork and documentation required

Types of 203k Mortgages

There are two types of 203k mortgages: the standard 203k and the limited 203k. The standard 203k is used for more extensive repairs and renovations, while the limited 203k is used for smaller repairs and renovations. Both types of loans have their own eligibility requirements and benefits.

How to Apply for a 203k Mortgage

To apply for a 203k mortgage, you'll need to follow these steps:

- Call 800.516.9166 or apply online.

- Complete an application and provide documentation of your credit score, income, and employment.

- Work with a consultant to develop a detailed renovation plan.

- Wait for the lender to review your application and determine if you're eligible.

- If you're approved, you'll need to complete the closing process and begin the renovation process.

Conclusion

If you're interested in buying a fixer-upper or an older home that needs some work, a 203k mortgage might be the financing solution you've been looking for. With the ability to finance both the purchase price and the cost of renovations or repairs, this type of loan can provide a path to homeownership that might otherwise be out of reach.

If you're considering a 203k mortgage, be sure to weigh the benefits and drawbacks carefully and consult with a qualified lender. With the right guidance and support, you can find the financing option that's right for you and start building the home of your dreams.

Call us 800.516.9166

www.MORTGAGE-WORLD.com LLC is an online mortgage company specializing in FHA loans for first time home buyers.

We look forward to working with you.

Call us 888-958-5382

www.MORTGAGE-WORLD.com LLC is an online mortgage company specializing in FHA loans for first time home buyers.

We look forward to working with you.

Call 800.516.9166

Recent Articles

-

Mortgage Rates August 5

Aug 05, 24 04:10 PM

Mortgage Rates August 5, 2024. Rates have gone down recently. Lower rates equals lower mortgage payment. -

Mortgage Rates August 5 2024

Aug 05, 24 03:55 PM

Mortgage Rates August 5 2024 -

Today's FHA Rates 5.00% & 5.875% Conventional Minimum 700 Credit Score

Aug 05, 24 03:48 PM

Today’s historically low 30 year fixed interest rates make now the perfect time to purchase a new home or refinance To be approved at the lowest mortgage rates, you do not need to have the highest cre…

Call Now, Our Staff is Available!

800.516.9166

Recent Articles

-

Mortgage Rates August 5

Aug 05, 24 04:10 PM

Mortgage Rates August 5, 2024. Rates have gone down recently. Lower rates equals lower mortgage payment. -

Mortgage Rates August 5 2024

Aug 05, 24 03:55 PM

Mortgage Rates August 5 2024 -

Today's FHA Rates 5.00% & 5.875% Conventional Minimum 700 Credit Score

Aug 05, 24 03:48 PM

Today’s historically low 30 year fixed interest rates make now the perfect time to purchase a new home or refinance To be approved at the lowest mortgage rates, you do not need to have the highest cre…