To Be Determined

To Be Determined

In

today's marketplace technology makes buying a home easier. Our platform

gets the buyer approved for a mortgage first. When the home buyer makes

an offer the financing has been secured you have an actual loan

approval. In fact, this gives the buyer more leverage and strength. This

creates a huge opportunity for the buyer and the agent especially in

regards to multiple offers. According to the National Association of

Realtors a home buyer will search for a property for an average of 12

weeks before writing a contract. With a formal loan approval it becomes

far easier to have an offer accepted and more importantly the offer will

be accepted faster. The home buyer will be more successful by securing a

loan approval earlier in the home buying process.

Current

turn time to get a loan approval is 72 hours from completing an

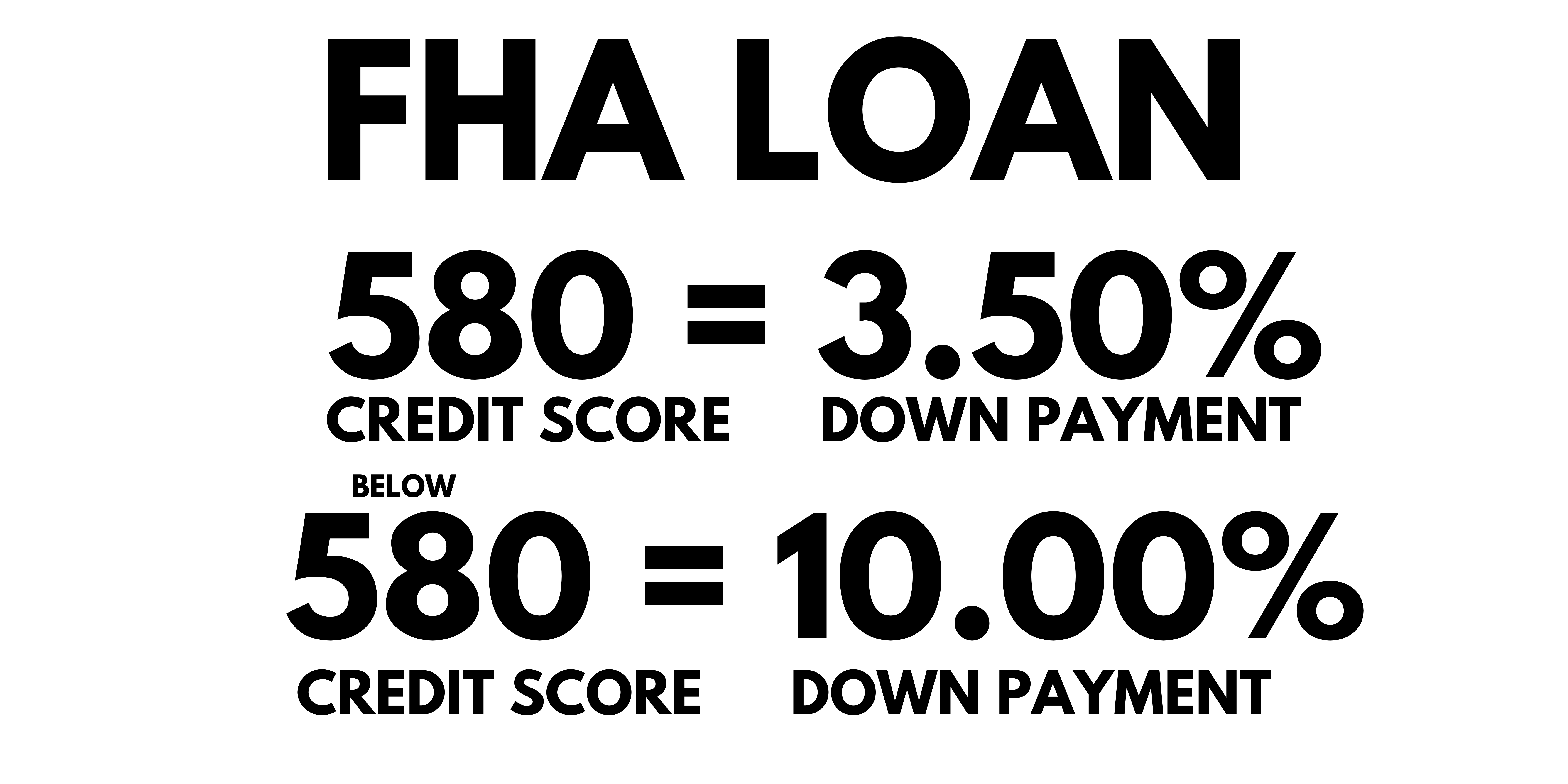

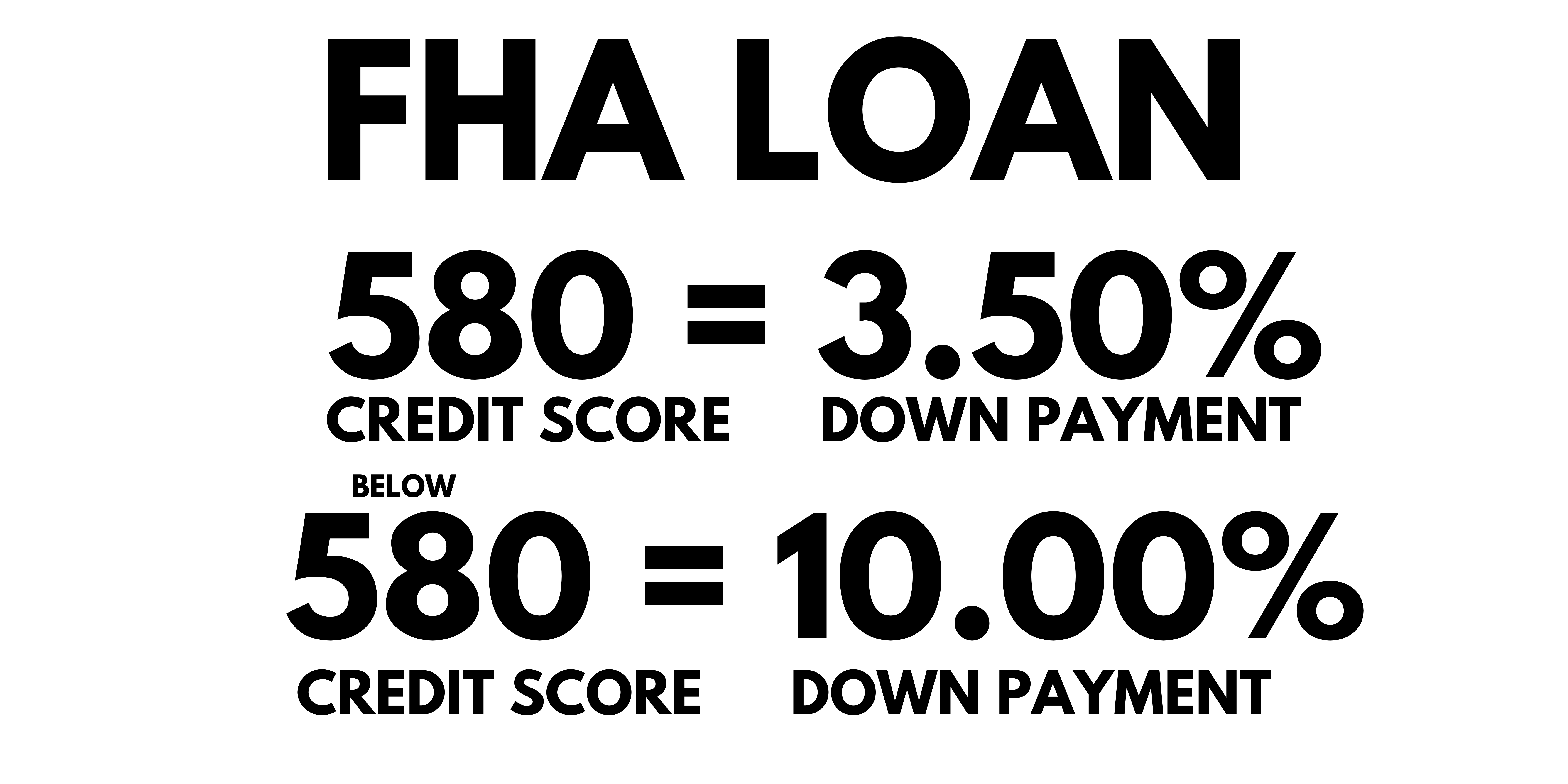

application. Loan programs are available for Conventional minimum 620

credit score, FHA minimum 500 credit score and VA minimum 500 credit

score.

Call us 888-958-5382

www.MORTGAGE-WORLD.com LLC is an online mortgage company specializing in FHA loans for first time home buyers.

Call us 888-958-5382

www.MORTGAGE-WORLD.com LLC is an online mortgage company specializing in FHA loans for first time home buyers.

We look forward to working with you.

We look forward to working with you.

Call 888-958-5382

Not sure where to start?

Take the first step. Let us get you approved.

Recent Articles

-

Mortgage Rates August 5

Aug 05, 24 04:10 PM

Mortgage Rates August 5, 2024. Rates have gone down recently. Lower rates equals lower mortgage payment. -

Mortgage Rates August 5 2024

Aug 05, 24 03:55 PM

Mortgage Rates August 5 2024 -

Today's FHA Rates 5.00% & 5.875% Conventional Minimum 700 Credit Score

Aug 05, 24 03:48 PM

Today’s historically low 30 year fixed interest rates make now the perfect time to purchase a new home or refinance To be approved at the lowest mortgage rates, you do not need to have the highest cre…

Call Now, Our Staff is Available!

800.516.9166