FHA Purchase

FHA purchase - FHA announced a set of policy changes to strengthen the FHA. The changes announced are the latest in a series of changes enacted in order to better position the FHA to manage its risk while continuing to support the nation’s housing market recovery.

FHA requires a minimum credit score of 500. There are no income limits like you may find with other first time home buyer programs. However, there are limits on how much you can borrow.

- 203(b) FHA purchase program provides mortgages for home buyers to purchase a principal residence with a low-down payment and with lower credit standards.

- 203(k) FHA purchase program is for the rehabilitation and repair of single-family properties. Providing both the financing to purchase a property and the financing to make repair. The program offers an important tool for expanding home ownership opportunities.

- HUD $100 down payment program for borrowers purchasing single-family HUD Real Estate Owned (REO). The program is limited to owner-occupant buyers who have not purchased a HUD REO property within the last 24 months.

- Lease with option to buy mortgage. Lease

with option to buy allows a renter to buy the property they are renting.

A lease option mortgage allows for seller's credit.

- Gift of equity mortgage loan. A gift of equity is a transfer of ownership of a property to a family member or someone. Gift of equity down payment and gift funds requirements.

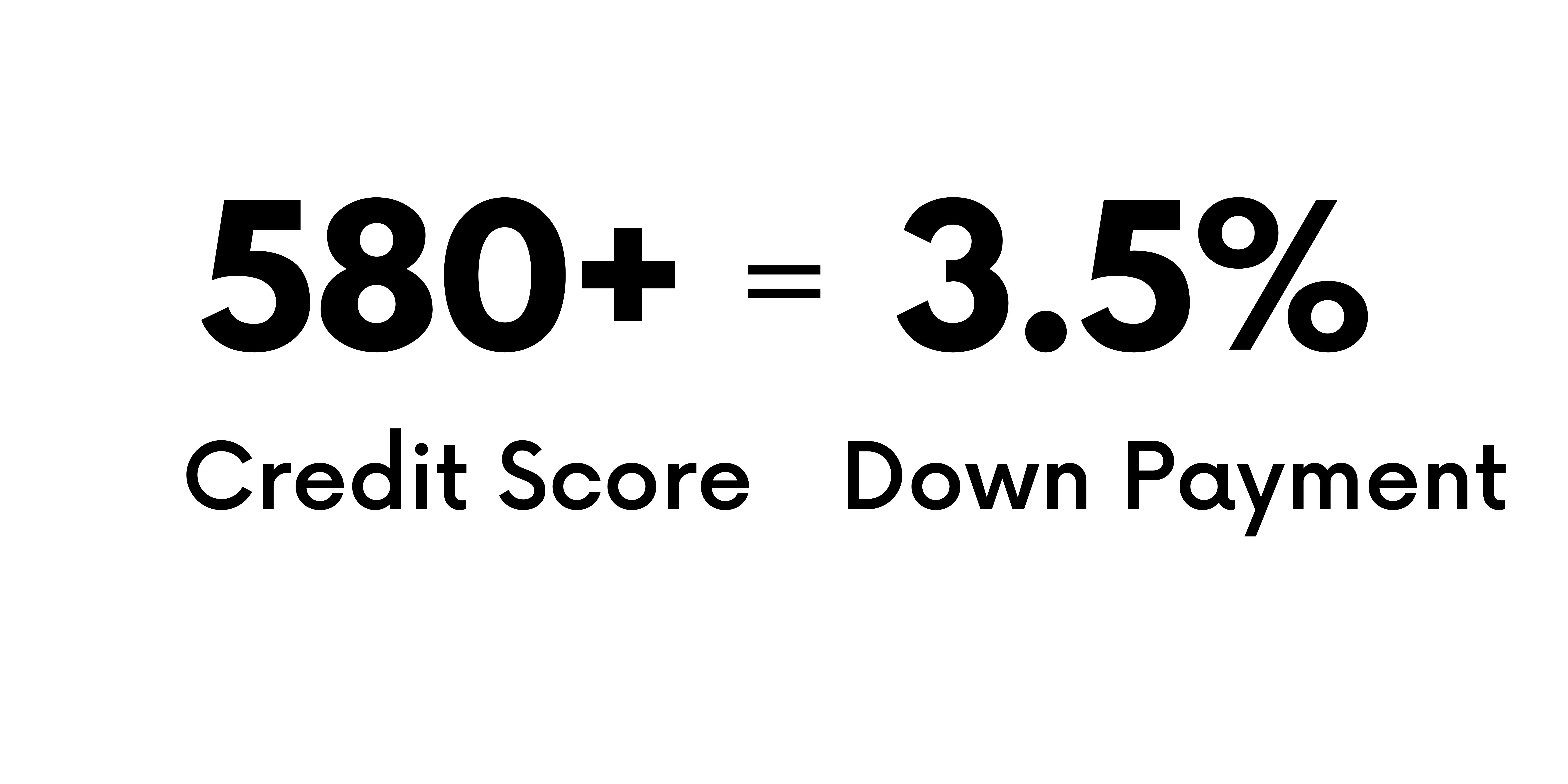

FHA allows a home buyer to make a down payment of 3.50% and a seller contribution of up to 6% for closing costs with only a 580 minimum credit score. First time home buyer with credit scores below 580 must make a minimum 10.0% down payment of the purchase price and a seller concession of up to 6% to pay for closing cost is allowed.

FHA requires a minimum down payment of 3.50% of the purchase price. The funds may be the borrower's own funds, a gift from a family member, rent credit or borrowed. FHA regulates some of the closing costs associated with a FHA loan.

Credit score - On January 20, 2010, FHA announced a new policy to address risk. FHA changed the minimum credit score for new borrowers.

- FHA requirements new borrowers will now be required to have a

minimum credit score of 580 to qualify for 3.5% down payment

- Borrowers with less than a 580-credit score will be required to put down at least 10%

- Minimum 500 credit score

This has allowed the FHA to better balance its risk and continue to provide financing for home buyers.

Call us 888-958-5382

www.MORTGAGE-WORLD.com LLC is an online mortgage company specializing in FHA loans for first time home buyers.

We look forward to working with you.

Call us 888-958-5382

www.MORTGAGE-WORLD.com LLC is an online mortgage company specializing in FHA loans for first time home buyers.

We look forward to working with you.

Recent Articles

-

Mortgage Rates August 5

Aug 05, 24 04:10 PM

Mortgage Rates August 5, 2024. Rates have gone down recently. Lower rates equals lower mortgage payment. -

Mortgage Rates August 5 2024

Aug 05, 24 03:55 PM

Mortgage Rates August 5 2024 -

Today's FHA Rates 5.00% & 5.875% Conventional Minimum 700 Credit Score

Aug 05, 24 03:48 PM

Today’s historically low 30 year fixed interest rates make now the perfect time to purchase a new home or refinance To be approved at the lowest mortgage rates, you do not need to have the highest cre…

Call Now, Our Staff is Available!

800.516.9166

Call 888-958-5382

Recent Articles

-

Mortgage Rates August 5

Aug 05, 24 04:10 PM

Mortgage Rates August 5, 2024. Rates have gone down recently. Lower rates equals lower mortgage payment. -

Mortgage Rates August 5 2024

Aug 05, 24 03:55 PM

Mortgage Rates August 5 2024 -

Today's FHA Rates 5.00% & 5.875% Conventional Minimum 700 Credit Score

Aug 05, 24 03:48 PM

Today’s historically low 30 year fixed interest rates make now the perfect time to purchase a new home or refinance To be approved at the lowest mortgage rates, you do not need to have the highest cre…