The Ultimate Guide to FHA Cash-Out Refinance

If you're a homeowner in need of extra cash for home improvements, debt consolidation, or other expenses, an FHA cash-out refinance might be the solution you need. This type of mortgage allows you to refinance your existing mortgage and take out additional cash from the equity in your home.

In this guide, we'll cover everything you need to know about FHA cash-out refinance, including eligibility requirements, benefits, and how to apply. Whether you're a first-time homeowner or a seasoned investor, our comprehensive guide will provide you with the knowledge you need to make an informed decision.

What is an FHA Cash-Out Refinance?

An FHA cash-out refinance is a type of mortgage that allows you to refinance your existing mortgage and take out additional cash from the equity in your home. This type of mortgage is backed by the Federal Housing Administration and can be a great option if you need extra cash for home improvements, debt consolidation, or other expenses.

Eligibility Requirements

To be eligible for an FHA cash-out refinance, you'll need to meet certain requirements, including:

- You must have an existing FHA mortgage.

- You must have made at least six payments on your current mortgage.

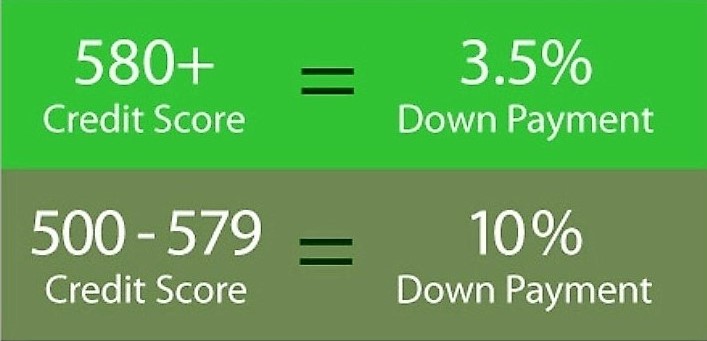

- Your credit score must be at least 580.

- You must have a debt-to-income ratio of 43% or less.

Benefits of FHA Cash-Out Refinance

There are many benefits to FHA cash-out refinance, including:

- Access to Cash: An FHA cash-out refinance allows you to access the equity in your home, which can be a valuable source of cash for home improvements, debt consolidation, or other expenses.

- Lower Interest Rates: You may be able to get a lower interest rate on your new mortgage than you had on your previous mortgage. This can lower your monthly payment and save you money over the life of the loan.

- Debt Consolidation: You can use the cash from your FHA cash-out refinance to pay off high-interest debt, such as credit card balances or personal loans. This can simplify your finances and save you money on interest charges.

- One Monthly Payment: With an FHA cash-out refinance, you can combine your first mortgage and cash-out refinance into one monthly payment. This can simplify your finances and make it easier to manage your budget.

- Flexible Eligibility Requirements: FHA loans offer more flexible eligibility requirements than traditional mortgages. This can make it easier for you to qualify for a loan, even if you have less-than-perfect credit.

How to Apply for an FHA Cash-Out Refinance

To apply for a 203k mortgage, you'll need to follow these steps:

- Call 800.516.9166 or apply online.

- Complete an application and provide documentation of your credit score, income, and employment.

- Wait for the lender to review your application and determine if you're eligible.

- Wait for the lender to approve the loan and close on the mortgage.

Conclusion

If you're a homeowner in need of extra cash, an FHA cash-out refinance can be an excellent option. With more flexible eligibility requirements and the ability to access the equity in your home, you can get the extra cash you need to pay for expenses like home improvements, debt consolidation, or other expenses.

If you're considering an FHA cash-out refinance, be sure to weigh the benefits and drawbacks carefully and consult with a qualified lender. With the right guidance and support, you can find the financing option that's right for you and start enjoying the extra cash you need to achieve your financial goals.

Call us 800.516.9166

www.MORTGAGE-WORLD.com LLC is an online mortgage company specializing in FHA loans for first time home buyers.

We look forward to working with you.

Call us 888-958-5382

www.MORTGAGE-WORLD.com LLC is an online mortgage company specializing in FHA loans for first time home buyers.

We look forward to working with you.

Call 800.516.9166

Recent Articles

-

Mortgage Rates August 5

Aug 05, 24 04:10 PM

Mortgage Rates August 5, 2024. Rates have gone down recently. Lower rates equals lower mortgage payment. -

Mortgage Rates August 5 2024

Aug 05, 24 03:55 PM

Mortgage Rates August 5 2024 -

Today's FHA Rates 5.00% & 5.875% Conventional Minimum 700 Credit Score

Aug 05, 24 03:48 PM

Today’s historically low 30 year fixed interest rates make now the perfect time to purchase a new home or refinance To be approved at the lowest mortgage rates, you do not need to have the highest cre…

Call Now, Our Staff is Available!

800.516.9166

Recent Articles

-

Mortgage Rates August 5

Aug 05, 24 04:10 PM

Mortgage Rates August 5, 2024. Rates have gone down recently. Lower rates equals lower mortgage payment. -

Mortgage Rates August 5 2024

Aug 05, 24 03:55 PM

Mortgage Rates August 5 2024 -

Today's FHA Rates 5.00% & 5.875% Conventional Minimum 700 Credit Score

Aug 05, 24 03:48 PM

Today’s historically low 30 year fixed interest rates make now the perfect time to purchase a new home or refinance To be approved at the lowest mortgage rates, you do not need to have the highest cre…