FHA Bad Credit Refinance: A Second Chance at Homeownership

In the ever-changing landscape of the real estate market, owning a home is often considered a cornerstone of financial stability and a symbol of the American dream. However, life's twists and turns can sometimes lead to financial challenges, resulting in a less-than-ideal credit score. If you find yourself in this situation, you might wonder if homeownership is still within your reach. Fortunately, the Federal Housing Administration (FHA) offers a lifeline in the form of FHA bad credit refinance loans. In this comprehensive guide, we'll explore how FHA bad credit refinance programs work and how they can provide a second chance for individuals with less-than-perfect credit histories.

Understanding the FHA

What Is the FHA?

The FHA, which stands for the Federal Housing Administration, is a government agency in the United States. This agency plays a crucial role in the housing market by offering support to homebuyers, especially those who face challenges such as limited funds for a down payment and lower credit scores. Unlike traditional lenders, the FHA does not directly provide loans to borrowers. Instead, it insures loans provided by approved lenders, making it easier for people to qualify for mortgages and achieve homeownership. The FHA's primary aim is to make housing more accessible and affordable for a broader range of individuals and families, ultimately promoting stable communities and homeownership opportunities.

The Importance of Credit Scores

Credit scores hold significant importance when it comes to financial matters, particularly in the context of obtaining a mortgage or other types of loans. These scores serve as numerical representations of an individual's creditworthiness and financial responsibility. Here's why they are crucial:

- Loan Approval: Lenders, whether traditional banks or institutions offering FHA loans, rely on credit scores to evaluate the risk associated with lending money. Higher credit scores indicate lower risk, making it more likely for borrowers to get approved for loans.

- Interest Rates: Credit scores directly influence the interest rates offered on loans. Borrowers with excellent credit scores typically qualify for lower interest rates, which can translate into substantial savings over the life of a loan. On the other hand, individuals with lower credit scores may face higher interest rates, potentially increasing the cost of borrowing.

- Loan Terms: Credit scores can also affect the terms of a loan, such as the duration of the loan and the size of the down payment required. Those with higher credit scores often enjoy more favorable terms and conditions.

- Access to Credit: Beyond mortgages, credit scores impact access to other forms of credit, such as credit cards and personal loans. A good credit score can open doors to a broader range of financial opportunities.

- Financial Flexibility: Individuals with strong credit scores have more financial flexibility. They can negotiate better terms on loans, access larger lines of credit, and respond more effectively to unexpected financial challenges.

- Insurance Rates: In some cases, credit scores can even influence insurance premiums. Some insurance companies use credit scores to assess risk and determine the cost of coverage.

- Employment and Housing: Credit scores may also be considered by potential employers and landlords during the hiring process or when renting a property. A poor credit history can sometimes impact job opportunities or rental applications.

Given these implications, it's crucial for individuals to monitor their credit scores regularly and take steps to improve them if necessary. Responsible financial behavior, such as making timely payments, managing debt wisely, and avoiding excessive credit inquiries, can all contribute to higher credit scores and greater financial opportunities.

The minimum credit score FHA allows is 500. Even with recent late payments on the mortgage, a borrower may still be able to qualify.

FHA Bad Credit Refinance

What Is FHA Bad Credit Refinance?

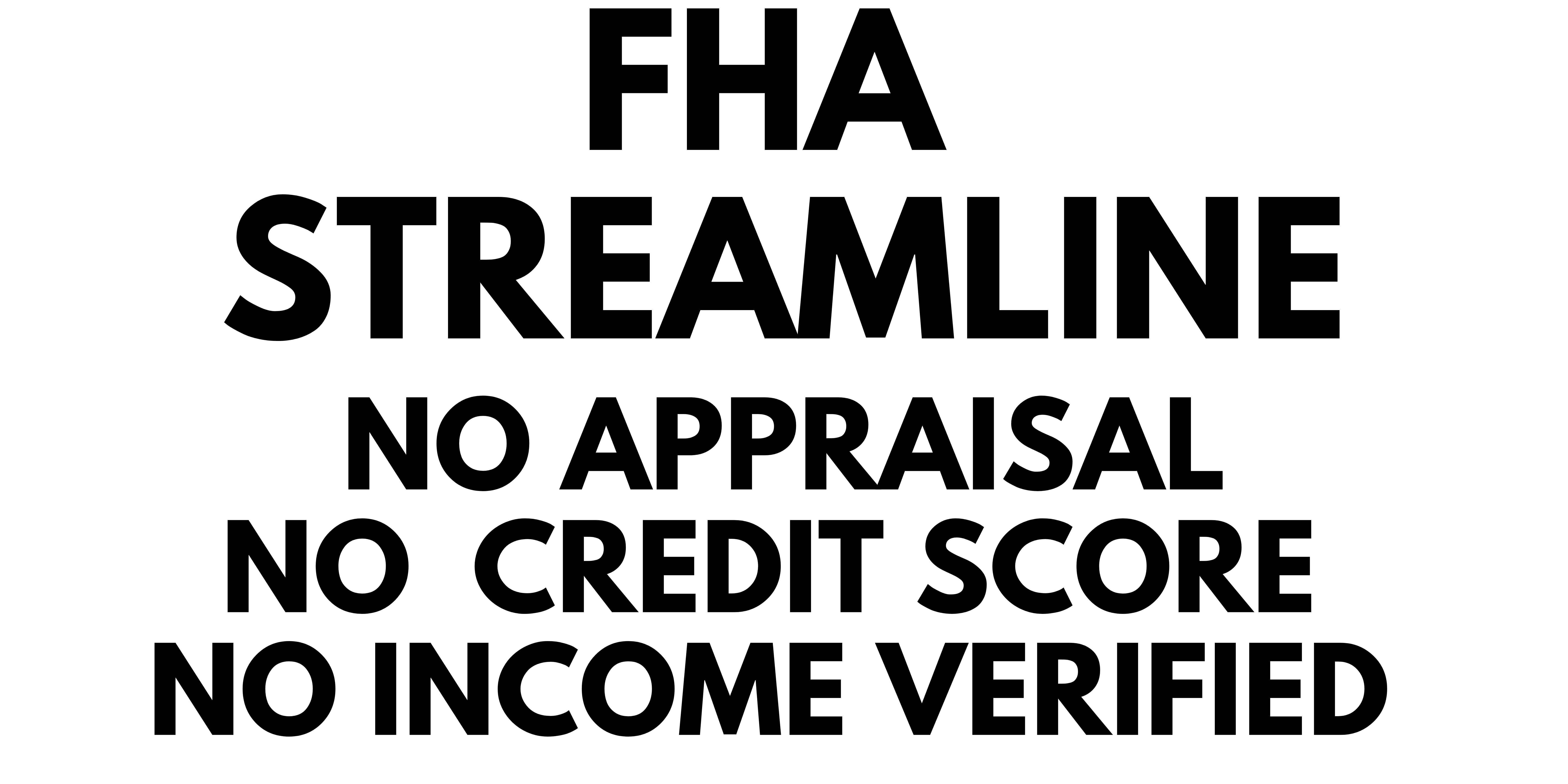

FHA Bad Credit Refinance, also known as an FHA Streamline Refinance with Bad Credit, is a specialized financial program offered by the Federal Housing Administration (FHA) to help homeowners with less-than-ideal credit scores refinance their existing mortgages. This program is designed to provide homeowners with the opportunity to improve their financial situations by taking advantage of the benefits offered by FHA-backed loans, even if their credit history has some blemishes.

Here's how FHA Bad Credit Refinance works:

- Lower Credit Requirements: Unlike conventional lenders who often require high credit scores, FHA loans are more lenient when it comes to credit requirements. Borrowers with lower credit scores can still qualify for these loans.

- Reduced Documentation: FHA Bad Credit Refinance typically requires less documentation compared to traditional refinancing. This streamlined process simplifies and expedites the application.

- Lower Interest Rates: FHA loans often offer competitive interest rates, which can result in lower monthly mortgage payments, potentially saving homeowners money.

- Stable Payments: FHA Bad Credit Refinance loans can provide borrowers with fixed-rate mortgages, ensuring stable and predictable monthly payments.

- Cash-Out Option: In addition to rate and term refinancing, FHA Bad Credit Refinance allows homeowners to tap into their home's equity through a cash-out refinance. This can be a valuable resource for debt consolidation, home improvements, or other financial needs.

To qualify for FHA Bad Credit Refinance, homeowners typically need to meet certain eligibility criteria, which may include:

- Having an existing FHA loan.

- Meeting a minimum credit score requirement (often lower than conventional lenders).

- Demonstrating a history of on-time mortgage payments.

It's important to note that while FHA Bad Credit Refinance can be an excellent option for those with credit challenges, borrowers should carefully consider the costs and benefits, as well as the impact on their long-term financial goals. Additionally, working with an FHA-approved lender who specializes in these programs can provide valuable guidance throughout the application process.

Eligibility Criteria

Eligibility criteria for FHA Bad Credit Refinance, also known as an FHA Streamline Refinance with Bad Credit, are specific requirements that homeowners must meet to qualify for this specialized mortgage program. While FHA loans are generally more lenient when it comes to credit requirements, there are still certain conditions that must be met. Here are the typical eligibility criteria:

- Existing FHA Loan: To be eligible for FHA Bad Credit Refinance, you must currently have an existing FHA-insured mortgage. This program is designed for homeowners who want to refinance their existing FHA loan.

- Credit Score: While FHA loans are known for being more forgiving of lower credit scores compared to traditional lenders, there is still a minimum credit score requirement. The specific credit score threshold can vary among lenders, but a credit score of 580 or higher is often recommended. Keep in mind that some lenders may have their own credit score requirements.

- Payment History: You should have a history of making on-time mortgage payments on your existing FHA loan. Lenders typically look for a consistent record of timely payments as an indicator of your ability to manage a new mortgage.

- Loan-to-Value Ratio (LTV): The LTV ratio is the ratio of the new loan amount to the appraised value of your home. While FHA Bad Credit Refinance loans often have more relaxed LTV requirements compared to other programs, the specific ratio allowed can vary. Typically, you should have a reasonable amount of equity in your home, but exact requirements depend on the lender and other factors.

- Financial Stability: Lenders may evaluate your overall financial stability, including your income, employment history, and debt-to-income ratio. Having a steady source of income and manageable debt levels can increase your chances of approval.

- FHA Streamline Guidelines: In addition to the general eligibility criteria, borrowers must adhere to the specific guidelines outlined by the FHA for streamline refinances. These guidelines include provisions for reducing the borrower's interest rate and monthly mortgage payment.

It's essential to keep in mind that eligibility criteria may vary slightly from one lender to another. Therefore, if you're interested in pursuing an FHA Bad Credit Refinance, it's advisable to consult with an FHA-approved lender who can assess your individual financial situation and guide you through the application process based on their specific requirements. Meeting these eligibility criteria can provide homeowners with the opportunity to improve their financial situation and potentially lower their monthly mortgage payments.

Advantages of FHA Bad Credit Refinance

Lower Interest Rates

One of the key advantages of FHA Bad Credit Refinance, also known as an FHA Streamline Refinance with Bad Credit, is the potential for lower interest rates. This aspect can have a significant impact on a homeowner's financial situation. Here's why lower interest rates matter:

- Reduced Monthly Payments: Lower interest rates translate to reduced monthly mortgage payments. When you refinance your existing FHA loan at a lower interest rate, your new monthly payments will be more affordable, allowing you to allocate your budget to other financial priorities.

- Savings Over Time: Over the life of your mortgage, lower interest rates can lead to substantial savings. You'll pay less in interest, which means more of your payments go toward paying down the principal balance of your loan. This can result in thousands of dollars in savings over the long term.

- Improved Cash Flow: Lower monthly mortgage payments can free up more of your monthly income. This improved cash flow can be used for various purposes, such as saving for the future, investing, or covering other essential expenses.

- Financial Stability: With lower interest rates, you are less susceptible to interest rate fluctuations in the market. Fixed-rate FHA Bad Credit Refinance loans, in particular, offer stability because your interest rate remains the same throughout the loan term, protecting you from rising interest rates.

- Debt Management: Lower mortgage payments can also make it easier to manage other debts. If you have high-interest debt, such as credit card balances, you may use the extra money saved from lower mortgage payments to pay down these debts faster, potentially improving your overall financial health.

- Homeownership Sustainability: More affordable monthly payments make homeownership sustainable for individuals and families with challenging credit histories. It reduces the risk of default and foreclosure, allowing homeowners to stay in their homes and build equity.

It's important to note that the specific interest rate you qualify for in an FHA Bad Credit Refinance can vary based on several factors, including your credit score, the lender's policies, and prevailing market conditions. Therefore, it's advisable to shop around and compare offers from different FHA-approved lenders to secure the most favorable interest rate for your refinance. Lower interest rates not only make homeownership more affordable but also contribute to your long-term financial well-being.

Improved Credit Standing

An essential benefit of FHA Bad Credit Refinance, or an FHA Streamline Refinance with Bad Credit, is the potential for improving your credit standing. This can have a positive and lasting impact on your overall financial health. Here's how FHA Bad Credit Refinance can contribute to an improved credit standing:

- Timely Payments: When you refinance your existing FHA loan, it provides an opportunity to reset your mortgage payment history. Making timely payments on your new loan can help establish a pattern of financial responsibility, which is a crucial factor in building and maintaining good credit.

- Reduced Financial Stress: Lowering your monthly mortgage payments through a refinance can reduce financial stress and make it easier to manage your expenses. This can lead to fewer late payments on your mortgage, further improving your payment history.

- Consistent Payment History: Consistency in making on-time payments is a fundamental component of a positive credit history. By refinancing to a more manageable mortgage payment, you're more likely to maintain a consistent payment history, which is a positive signal to creditors.

- Debt Management: If you use the extra funds from lower mortgage payments to pay down high-interest debt, such as credit cards, it can reduce your overall debt load. Lowering your credit card balances can positively impact your credit utilization ratio, a key factor in credit scoring.

- Credit Score Impact: As your payment history improves and you manage your debts more effectively, your credit score is likely to increase over time. A higher credit score opens doors to better financial opportunities, including lower interest rates on future loans and credit cards.

- Long-Term Financial Goals: An improved credit standing isn't just about short-term benefits. It can play a vital role in achieving long-term financial goals, such as homeownership, securing favorable interest rates, and building wealth.

- Financial Confidence: As your credit standing improves, you gain more confidence in your financial abilities. This confidence can translate into smarter financial decisions and more responsible money management.

It's crucial to recognize that improving your credit standing takes time and consistent effort. While FHA Bad Credit Refinance can be a valuable tool in this process, it's equally important to continue practicing responsible financial habits, such as making all your payments on time, managing debt wisely, and avoiding excessive credit inquiries. Over time, these actions can help you rebuild and strengthen your credit, providing access to even more financial opportunities in the future.

Cash-Out Refinance Option

One of the appealing features of FHA Bad Credit Refinance, or an FHA Streamline Refinance with Bad Credit, is the availability of a cash-out refinance option. This feature allows homeowners to tap into the equity they have built in their homes and receive a lump sum of cash in the process. Here's how the cash-out refinance option works and how it can benefit homeowners:

How Cash-Out Refinance Works:

- Equity Assessment: Before proceeding with a cash-out refinance, your lender will assess the current appraised value of your home and the remaining balance on your mortgage. The difference between the two represents your home equity.

- Loan Amount: Based on your equity and other qualifying factors, you can refinance your existing FHA loan for an amount that exceeds your current mortgage balance. The excess amount is provided to you in cash at closing.

Benefits of Cash-Out Refinance:

- Debt Consolidation: Many homeowners use the cash-out refinance option to consolidate high-interest debts, such as credit card balances or personal loans. By paying off these debts with a lower-interest mortgage, you can save money on interest and simplify your monthly payments.

- Home Improvements: The cash-out funds can be used for home improvements and renovations. This can increase the value of your property and enhance your living space.

- Emergency Funds: Some homeowners choose to access their home equity as an emergency fund. Having a lump sum of cash on hand can provide a financial safety net for unexpected expenses.

- Investment Opportunities: The cash from a cash-out refinance can be used for investment purposes, such as starting a business, investing in stocks, or purchasing additional real estate.

- Education Expenses: Some homeowners use the funds to pay for higher education expenses, either for themselves or their children.

- Reduced Interest Rates: Since the cash-out funds are part of your mortgage, they typically come with a lower interest rate compared to credit cards or personal loans, potentially saving you money in interest payments.

It's essential to approach cash-out refinancing with careful consideration. While it offers financial flexibility, it also increases the total loan amount and extends the time it takes to pay off your mortgage. Borrowers should have a clear plan for how they intend to use the funds and ensure that the benefits of a cash-out refinance outweigh the costs and potential risks.

Additionally, eligibility for a cash-out refinance, including the maximum amount you can withdraw, depends on factors such as your home's value, your creditworthiness, and the lender's policies. Working closely with an FHA-approved lender can help you determine if a cash-out refinance is the right financial move for your specific situation.

How to Apply

Finding an Approved Lender

Finding an approved lender for your FHA Bad Credit Refinance is a critical step in the process. FHA-approved lenders are essential because they have the necessary expertise and authorization to offer FHA-insured loans, including refinancing options. Here's how you can find a suitable approved lender:

- FHA Website: Start your search by visiting the official website of the Federal Housing Administration (FHA). They provide a searchable database of approved lenders by state. You can use this tool to find lenders in your area.

- Mortgage Brokers: Mortgage brokers often work with multiple lenders, including FHA-approved ones. They can help you identify lenders that offer FHA Bad Credit Refinance programs tailored to your situation.

- Recommendations: Ask friends, family, or colleagues who have gone through the FHA refinancing process for recommendations. Personal referrals can provide valuable insights into the lender's service quality and reliability.

- Consultation: Reach out to potential lenders for a consultation or pre-qualification. During this initial conversation, you can discuss your financial situation, credit history, and refinancing goals. This helps you assess whether the lender is a good fit for your needs.

- Read Reviews: Research online reviews and customer feedback for the lenders you're considering. Reviews can provide insights into the experiences of other borrowers and help you gauge the lender's reputation.

- Ask Questions: Don't hesitate to ask lenders questions about their FHA refinancing programs, eligibility criteria, and any specific requirements they may have. Clarify any doubts you may have before moving forward.

- Evaluate Customer Service: Consider the responsiveness and professionalism of the lender's customer service team. Good communication and support can be essential throughout the refinancing process.

Remember that the selection of a lender is a crucial decision that can impact your refinancing experience and financial outcomes. Take the time to research and compare your options thoroughly. Once you've chosen an FHA-approved lender, they will guide you through the application process, helping you determine if you meet the eligibility criteria and assisting you in securing an FHA Bad Credit Refinance that suits your needs and financial goals.

Gather Documentation

Gathering the necessary documentation is a crucial step when applying for FHA Bad Credit Refinance, also known as an FHA Streamline Refinance with Bad Credit. Lenders require specific paperwork to assess your eligibility and process your loan application efficiently. Here's a list of the typical documentation you'll need:

- Proof of Identity: You'll need a government-issued photo ID, such as a driver's license or passport, to verify your identity.

- Income Verification: Provide documentation of your income, including:Pay Stubs: Copies of your most recent pay stubs showing your year-to-date earnings.W-2 Forms: Your W-2 forms for the past two years.Tax Returns: Federal income tax returns for the past two years, including all schedules.

- Employment History: Lenders may request information about your employment history, including your current job and previous positions held. Be prepared to provide employer contact information.

- Bank Statements: Copies of your bank statements for the past two to three months. These statements should show your account balances, transactions, and sources of income.

- Credit Report: Your lender will obtain a copy of your credit report, but it's advisable to review your credit history in advance to check for accuracy and address any discrepancies.

- Existing Mortgage Information: Details of your existing FHA mortgage, including your loan number, current loan balance, and payment history.

- Property Information: Information about the property you're refinancing, including the address and its current appraised value.

- Insurance: Proof of homeowner's insurance coverage on the property.

- Additional Debts: If you have other outstanding debts or obligations, provide documentation of these, such as credit card statements, car loan information, or student loan statements.

- Bankruptcy or Divorce Documents: If applicable, provide documentation related to any past bankruptcy filings or divorce decrees.

- Gift Letters (if applicable): If you're receiving financial assistance from family members or others to cover closing costs or fees, a gift letter stating the amount and purpose of the gift may be required.

- Additional Documentation: Depending on your unique financial situation, the lender may request additional documentation to verify income, assets, or liabilities.

It's essential to communicate openly with your chosen FHA-approved lender and ask them for a complete list of required documents specific to their application process. Organize these documents in advance to streamline the application process and avoid delays. Timely submission of accurate documentation can help expedite the evaluation of your eligibility for FHA Bad Credit Refinance and facilitate a smooth refinancing experience.

The Application Process

The application process for FHA Bad Credit Refinance, also known as an FHA Streamline Refinance with Bad Credit, involves several steps designed to evaluate your eligibility and secure your new mortgage terms. Here's an overview of the typical application process:

- Choose an FHA-Approved Lender: Begin by selecting an FHA-approved lender that offers FHA Bad Credit Refinance programs. Working with an experienced lender is crucial, as they can guide you through the process and ensure your application meets all requirements.

- Pre-Application Consultation: Schedule an initial consultation with your chosen lender. During this discussion, you'll discuss your financial situation, refinancing goals, and any questions or concerns you may have. The lender can provide guidance on the application process and eligibility criteria.

- Complete the Loan Application: Once you've selected a lender, you'll need to complete a loan application. This typically involves providing personal and financial information, including your income, assets, debts, and employment history.

- Credit Check: The lender will perform a credit check to assess your creditworthiness. This involves obtaining your credit score and reviewing your credit history. Remember that FHA Bad Credit Refinance programs are designed to accommodate lower credit scores, but having a clear understanding of your credit situation is essential.

- Property Appraisal: Your lender will order an appraisal of your property to determine its current market value. This step is necessary to calculate the loan-to-value ratio (LTV) and ensure that the property meets FHA requirements.

- Underwriting Review: The lender's underwriting team will review your application and documentation, including income verification, credit report, and property appraisal. They will assess your eligibility based on FHA guidelines and the lender's specific criteria.

- Loan Approval: If your application meets all requirements and is approved, the lender will issue a formal approval, outlining the terms and conditions of your FHA Bad Credit Refinance loan.

- Closing Disclosure: You'll receive a Closing Disclosure document that provides details of your loan, including interest rates, fees, and monthly payment amounts. Review this document carefully to ensure you understand the terms before proceeding.

- Closing Process: The closing process involves signing the final loan documents. You'll need to provide any additional documentation requested by the lender and pay any closing costs or fees required. During the closing, you'll sign the loan agreement, and the funds from the refinance will be disbursed.

- Loan Servicing: After closing, your loan will be serviced by the lender or a loan servicing company. You'll make monthly payments as outlined in your loan agreement.

Throughout the application process, it's essential to maintain open communication with your lender, promptly provide requested documentation, and address any questions or concerns that arise. FHA Bad Credit Refinance programs are designed to provide opportunities for homeowners with less-than-ideal credit histories, but a thorough and well-prepared application is key to a successful refinancing experience.

Conclusion

In conclusion, FHA bad credit refinance programs offer a glimmer of hope for individuals who thought homeownership was out of reach due to credit challenges. With their relaxed credit requirements, lower interest rates, and potential for cash-out refinancing, these programs provide a pathway to financial recovery and homeownership. If you're looking to take control of your financial future and access the benefits of homeownership, consider exploring the possibilities of FHA bad credit refinance.

Call us 888-958-5382

www.MORTGAGE-WORLD.com LLC is an online mortgage company specializing in FHA loans for first time home buyers.

We look forward to working with you.

Recent Articles

-

Mortgage Rates August 5

Aug 05, 24 04:10 PM

Mortgage Rates August 5, 2024. Rates have gone down recently. Lower rates equals lower mortgage payment. -

Mortgage Rates August 5 2024

Aug 05, 24 03:55 PM

Mortgage Rates August 5 2024 -

Today's FHA Rates 5.00% & 5.875% Conventional Minimum 700 Credit Score

Aug 05, 24 03:48 PM

Today’s historically low 30 year fixed interest rates make now the perfect time to purchase a new home or refinance To be approved at the lowest mortgage rates, you do not need to have the highest cre…

Call Now, Our Staff is Available!

800.516.9166