FHA Loan Requirements in New Jersey - An Introduction

Are you thinking about buying a home? Whether you're a first-time homebuyer or looking to upgrade your living space, the home buying process can be daunting. But with the right knowledge and guidance, you can make informed decisions and find the perfect home for you. In this complete guide to home buying, our experts share their tips and insights on everything you need to know, from understanding the home buying process to choosing the right mortgage and negotiating a fair price.

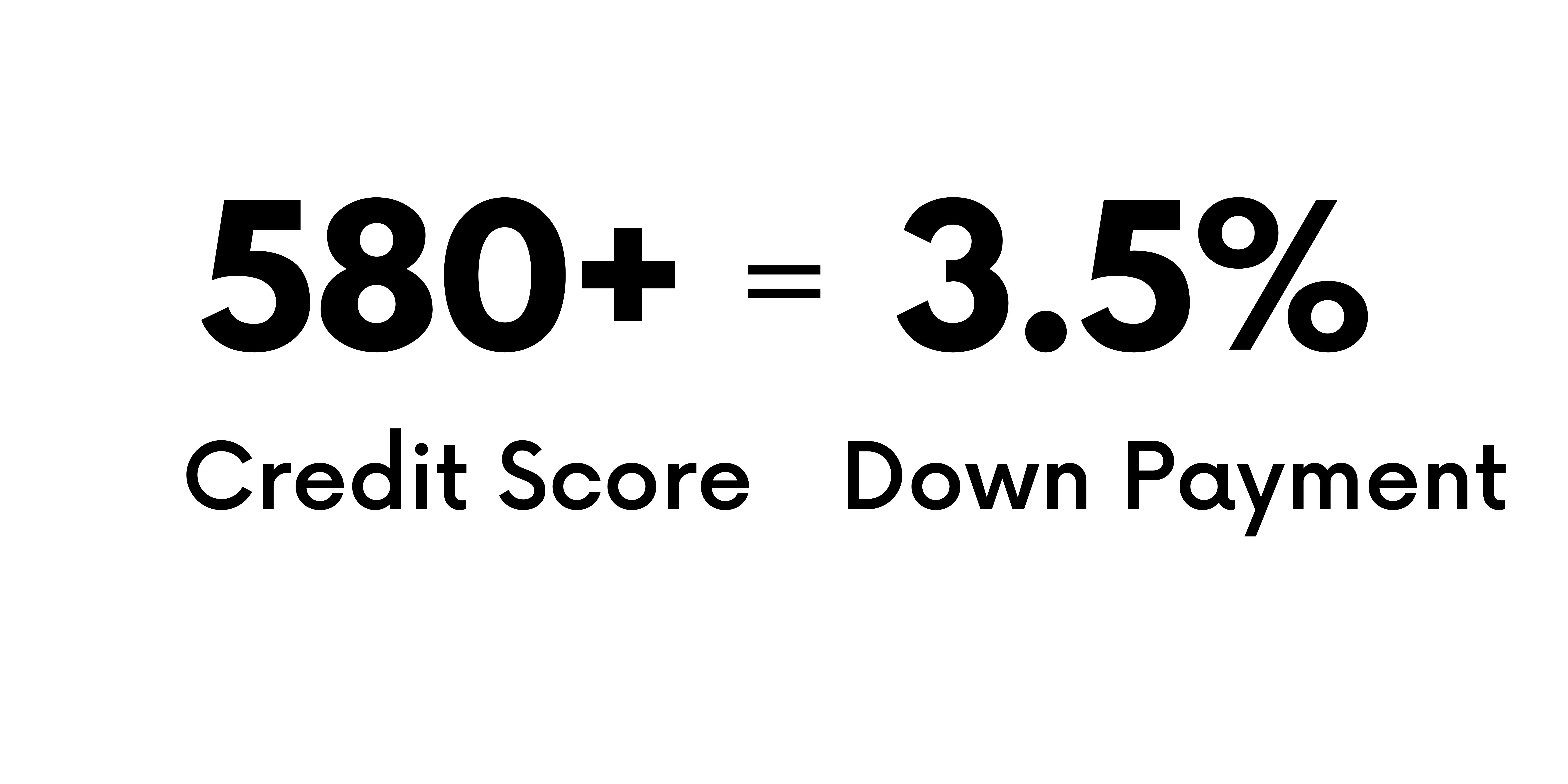

Credit Score Requirements for FHA Loans in New Jersey

For those looking to purchase a home in New Jersey, the minimum credit score requirement for an FHA loan is 500. This score is based on the Federal Housing Administration (FHA) guidelines, which are designed to ensure that borrowers have sufficient creditworthiness to be able to pay back their loan. The FHA also requires that borrowers have a steady income and proof of employment as well as a debt-to-income ratio of no more than 43%. Additionally, lenders may require additional information such as tax returns and bank statements. By meeting these criteria, borrowers can qualify for an FHA loan in New Jersey and take advantage of the low-down payment requirements and flexible terms associated with this type of loan.

Down Payment Requirements for FHA Loans in New Jersey

For prospective homebuyers in New Jersey, understanding the down payment requirements for FHA loans is essential. FHA loans are a popular option for those who are looking to purchase a home but may not have the necessary funds for a large down payment. In this article, we will discuss the down payment requirements for FHA loans in New Jersey and how they can help you achieve your homeownership goals.

Mortgage Insurance Requirements for FHA Loans in New Jersey

For New Jersey residents, getting a mortgage loan can be a confusing process. This is especially true when it comes to the mortgage insurance requirements for FHA loans. Understanding the requirements can help you determine if an FHA loan is right for you and what steps you need to take to get one. With this in mind, let's look at the mortgage insurance requirements for FHA loans in New Jersey. We'll discuss what they are, how they work, and why they are important to consider when applying for an FHA loan in New Jersey.

Other FHA Loan Requirements in New Jersey

FHA loans are an attractive option for New Jersey homebuyers, as they offer lower down payments and more flexible credit requirements than traditional mortgage loans. However, there are other FHA loan requirements in New Jersey that borrowers must meet in order to qualify for an FHA loan. These include income and asset requirements, debt-to-income ratio limits, and a minimum credit score. In addition, borrowers must be able to show proof of employment or other sources of steady income. By understanding the other FHA loan requirements in New Jersey, potential borrowers can better prepare themselves to apply for an FHA loan and increase their chances of being approved.

Debt-to-Income Ratio Requirements for FHA Loans in New Jersey

For those looking to purchase a home in New Jersey, understanding the debt-to-income (DTI) ratio requirements for FHA loans is essential. The DTI ratio is a measure of how much of an individual's income goes toward paying their debts. It is used by lenders to determine an individual's ability to repay the loan and is an important factor in determining eligibility for FHA loans. In this article, we will discuss the DTI ratio requirements for FHA loans in New Jersey and how it can impact your ability to get approved for such a loan. We will also discuss some strategies that can help you improve your chances of getting approved.

Property Requirements for FHA Loans in New Jersey

FHA loans are one of the most popular options for home buyers in New Jersey. To be eligible for an FHA loan, prospective borrowers must meet certain property requirements. These requirements include minimum property standards, as well as additional requirements that must be met if the borrower is purchasing a condominium or manufactured home. In this article, we will discuss the various property requirements for FHA loans in New Jersey. We will also look at how these requirements can help ensure that borrowers are able to purchase a safe and secure home that meets their needs and budget.

Income Requirements for FHA Loans in New Jersey

In order to qualify for an FHA loan in New Jersey, borrowers must meet certain income requirements. These requirements are based on the size of the loan and the borrower's ability to repay it. The income requirements for FHA loans in New Jersey vary depending on a variety of factors, such as credit score, down payment amount, and debt-to-income ratio. It is important to understand these requirements before applying for a loan in order to ensure that you are eligible. This article will provide an overview of the income requirements for FHA loans in New Jersey.

How to Qualify for an FHA Loan in New Jersey

Qualifying for an FHA loan in New Jersey can be a complex process. It requires careful research and understanding of the lender's requirements and the state's regulations. This guide will provide you with all the information you need to know about qualifying for an FHA loan in New Jersey, including what documents you must submit, what credit score requirements you must meet, and more. With this knowledge, you'll be able to confidently apply for an FHA loan in New Jersey and get approved quickly.

Finding a HUD-Approved Lender in New Jersey

To apply for a FHA loan, you’ll need to follow these steps:

- Call 800.516.9166 or apply online.

- Complete an application with credit history and no income verification.

- Wait for the lender to review your application and determine if you’re eligible.

- If you’re approved, you’ll need to complete the closing process and sign the loan documents.

Applying for an FHA Loan in New Jersey

Applying for an FHA Loan in New Jersey can be a daunting process, but with the right information and guidance, it can be a relatively stress-free experience. Knowing what documents are required and what to expect from the loan process is key to making sure that your application is successful. This guide will provide you with all the necessary information you need to know about applying for an FHA loan in New Jersey. We will discuss the eligibility requirements, the types of loans available, and how to get started on your application. With this guide, you will have all the tools necessary to make sure that your loan application is successful.

FHA Loan Limits in New Jersey

FHA Loan Limits in New Jersey are an important factor for homebuyers considering a loan insured by the Federal Housing Administration (FHA). The limits vary based on the county and municipality, and they are subject to change annually. Knowing the FHA Loan Limits in New Jersey can help homebuyers determine how much they can borrow, what kind of loan they qualify for, and how much interest they may pay. This article will provide an overview of FHA Loan Limits in New Jersey, including how to find them and what factors influence them.

Benefits of FHA Loans in New Jersey

FHA loans are a great option for those looking to purchase a home in New Jersey. These loans provide several benefits, including lower down payments and closing costs, flexible credit requirements, and more lenient debt-to-income ratios. With FHA loans, borrowers can also take advantage of the unique loan program that allows them to purchase a home with as little as 3.5% down payment. Additionally, FHA loans offer competitive interest rates and can be used to finance both primary residences and investment properties. With these benefits in mind, it's no wonder why so many people in New Jersey are taking advantage of FHA loans to finance their dream homes.

Lower Credit Score Requirements

Lowering credit score requirements is becoming increasingly important in today's economy. With more and more people struggling to make ends meet, it's essential that lenders offer more lenient credit score requirements. Lowering credit score requirements can help those with poor credit histories get access to the loans they need, while also providing lenders with a larger pool of potential borrowers. This can be beneficial for both parties, as it allows lenders to offer better rates and terms while also giving borrowers the chance to rebuild their credit. By lowering credit score requirements, lenders can expand their customer base and give people the opportunity to improve their financial situation.

Lower Down Payment Requirements

Lowering down payment requirements is a great way to help make homeownership possible for more people. By reducing the amount of money needed upfront, it can help those who may not have the funds to purchase a home. This can also reduce the overall cost of buying a home, making it more affordable for those who are on a tight budget. The lower down payment requirements can also be beneficial for first-time homebuyers, as they may not have the funds or credit score required to get into traditional mortgage loans with higher down payments. With lower down payments, buyers can get into their dream homes faster and easier than ever before.

Flexible Qualification Requirements

The FHA Flexible Qualification Requirements are designed to make it easier for potential home buyers to qualify for a mortgage. This program allows buyers with credit scores as low as 580, and down payments as low as 3.5%, to buy a home. It also offers more lenient debt-to-income ratio requirements, and allows the seller to pay up to 6% of the buyer's closing costs. With these flexible requirements, more people can become homeowners and build wealth through real estate investments.

Competitive Interest Rates

FHA loans offer competitive interest rates for those looking to buy a home. With an FHA loan, borrowers can expect to have lower down payments and closing costs than with other types of loans. Additionally, FHA loans offer more flexible credit requirements and are available to people with lower incomes. This makes them an attractive option for those who may not qualify for other types of financing. As a result, FHA competitive interest rates make it easier for more people to become homeowners.

Conclusion

Buying a home in New Jersey is a great investment but it can be challenging to meet the FHA loan requirements. Understanding these requirements and having the necessary documents ready before applying can make the process smoother and help you get approved faster. The FHA loan program is designed to help potential buyers get into a home they can afford while protecting them from predatory lenders. By understanding the requirements and being prepared, you can ensure that you have the best chance of getting approved for an FHA loan in New Jersey.

Call us 800.516.9166

www.MORTGAGE-WORLD.com LLC is an online mortgage company specializing in FHA loans for first time home buyers.

We look forward to working with you.

Call us 888-958-5382

www.MORTGAGE-WORLD.com LLC is an online mortgage company specializing in FHA loans for first time home buyers.

We look forward to working with you.

Recent Articles

-

Mortgage Rates August 5

Aug 05, 24 04:10 PM

Mortgage Rates August 5, 2024. Rates have gone down recently. Lower rates equals lower mortgage payment. -

Mortgage Rates August 5 2024

Aug 05, 24 03:55 PM

Mortgage Rates August 5 2024 -

Today's FHA Rates 5.00% & 5.875% Conventional Minimum 700 Credit Score

Aug 05, 24 03:48 PM

Today’s historically low 30 year fixed interest rates make now the perfect time to purchase a new home or refinance To be approved at the lowest mortgage rates, you do not need to have the highest cre…

Call Now, Our Staff is Available!

800.516.9166

Recent Articles

-

Mortgage Rates August 5

Aug 05, 24 04:10 PM

Mortgage Rates August 5, 2024. Rates have gone down recently. Lower rates equals lower mortgage payment. -

Mortgage Rates August 5 2024

Aug 05, 24 03:55 PM

Mortgage Rates August 5 2024 -

Today's FHA Rates 5.00% & 5.875% Conventional Minimum 700 Credit Score

Aug 05, 24 03:48 PM

Today’s historically low 30 year fixed interest rates make now the perfect time to purchase a new home or refinance To be approved at the lowest mortgage rates, you do not need to have the highest cre…