FHA Purchase in Florida: A Smart Path to Homeownership

Introduction

Purchasing a home is a dream for many, but the high down payment and strict credit requirements can make it challenging for some potential buyers to achieve. Luckily, the Federal Housing Administration (FHA) offers a solution for aspiring homeowners to qualify for an FHA Purchase in Florida. These loans provide numerous benefits and opportunities, making homeownership more accessible to a broader range of individuals.

An FHA purchase loan is a mortgage insured by the FHA, which is a part of the U.S. Department of Housing and Urban Development (HUD). This type of loan is specifically designed to help first-time homebuyers and those with limited financial resources qualify for a mortgage.

Advantages of an FHA Purchase in Florida

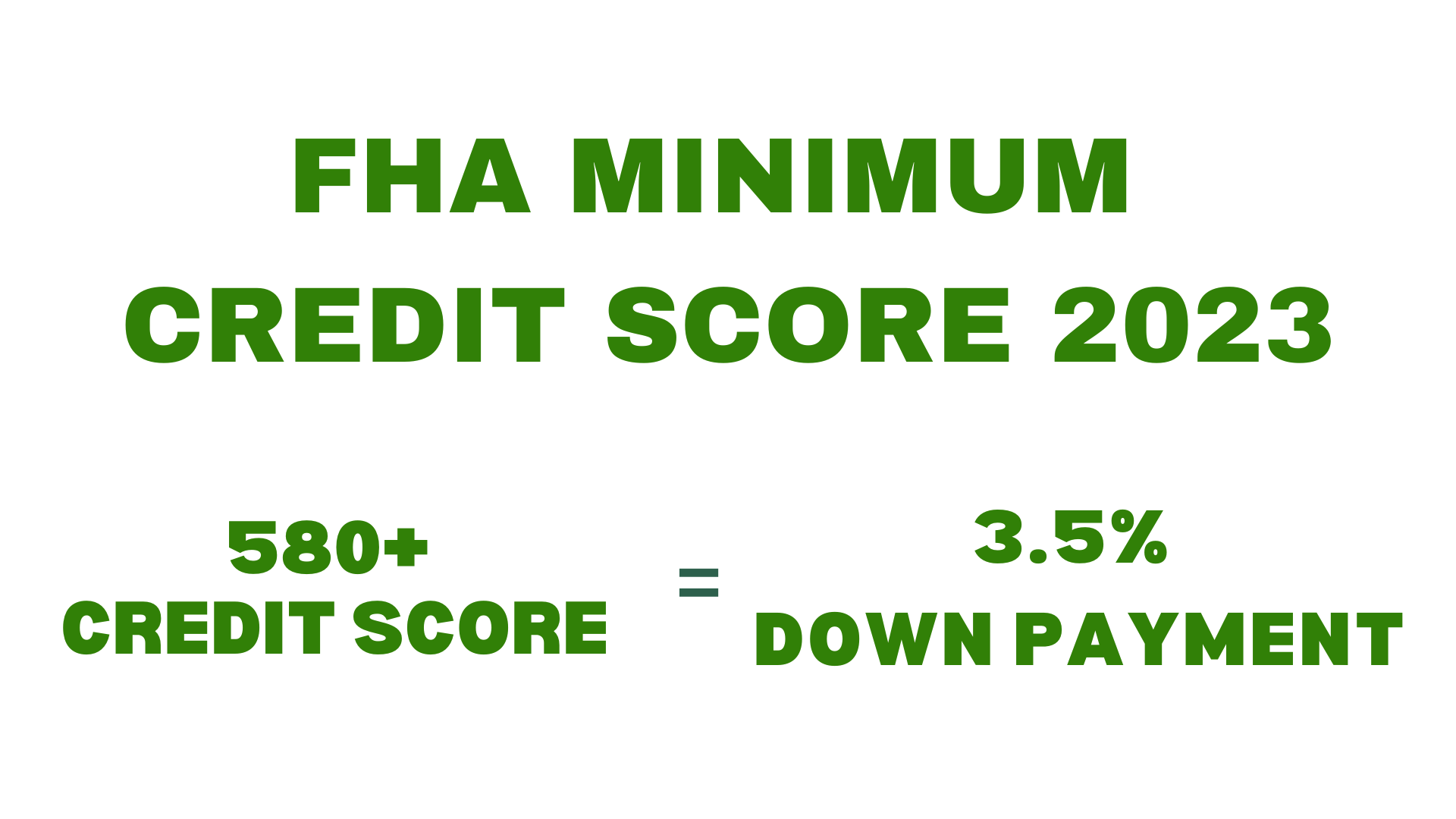

One of the primary advantages of an FHA purchase in Florida is the low down payment requirement. While conventional loans often require a down payment of 20% or more, an FHA loan typically only demands a down payment of 3.5% of the home's purchase price.

Fexible Credit Requirements

Another benefit of FHA loans is their more lenient credit score requirements. While conventional loans may demand a higher credit score, FHA loans are accessible to individuals with credit scores that are not as strong.

Competitive Interest Rates

FHA purchase loans often come with competitive interest rates, which can save borrowers thousands of dollars over the life of the loan.

Assumable Loans

FHA loans are assumable, meaning that if you decide to sell your home, the buyer can take over your existing FHA loan. This feature can be an attractive selling point if interest rates have increased since you initially obtained the loan.

Lenient Qualification Criteria

FHA loans have more lenient qualification criteria compared to conventional loans, making it easier for buyers with limited income or non-traditional sources of income to qualify.

FHA Loan Limits in Florida

The loan amount you can borrow through an FHA purchase loan in Florida is subject to FHA loan limits. These limits vary based on the county in which the property is located.

County-wise Loan Limits

Each county in Florida has its FHA loan limit, and these limits can vary significantly from one county to another. Some high-cost areas may have higher loan limits to account for the region's more expensive properties.

How Loan Limits are Determined

FHA loan limits are determined based on the median home prices in each area. They are typically updated annually to reflect changes in the real estate market.

FHA vs. Conventional Loans

Before committing to an FHA purchase in Florida, it's essential to understand the differences between FHA and conventional loans.

Down Payment Differences

As mentioned earlier, FHA loans have a lower down payment requirement of 3.5%, whereas conventional loans usually require a higher down payment.

Credit Score Requirements

While FHA loans have more flexible credit score requirements, conventional loans may demand a higher credit score for approval.

Mortgage Insurance

FHA loans require mortgage insurance premiums (MIP) to protect the lender in case of default. Conventional loans may also require private mortgage insurance (PMI) if the down payment is less than 20%.

Property Requirements

FHA loans have specific property requirements to ensure the safety and habitability of the home. Conventional loans may have fewer property requirements.

Eligibility Criteria for FHA Purchase in Florida

To qualify for an FHA purchase loan in Florida, certain eligibility criteria must be met:

Credit Score

While FHA loans are more flexible with credit scores, a higher credit score can still improve your chances of approval and secure a better interest rate.

Income Requirements

Borrowers must have a steady source of income and be able to demonstrate their ability to repay the loan.

Employment History

Lenders typically prefer borrowers with a stable employment history.

Debt-to-Income Ratio

The debt-to-income ratio is a critical factor in loan approval. Lenders want to ensure that borrowers have sufficient income to cover their monthly mortgage payments.

Property Eligibility

FHA loans are intended for primary residences, so the property you are purchasing must be your primary home.

How to Apply for an FHA Purchase Loan

Applying for an FHA purchase loan in Florida involves several steps:

Finding an FHA-approved Lender

Start by finding a reputable lender approved to offer FHA loans in Florida. Research different lenders and compare their terms and rates.

Lender Prequalification and Preapproval

Before house hunting, get prequalified or preapproved for an FHA purchase loan. Prequalification gives you an estimate of how much you can borrow, while preapproval strengthens your offer in the eyes of sellers.

Completing the Application

Once you find your dream home, work with your lender to complete the FHA purchase loan application.

Underwriting Process

The lender will review your application, verify the information, and assess your creditworthiness during the underwriting process.

Tips for a Successful FHA Purchase

Purchasing a home with an FHA loan can be a smooth process if you keep the following tips in mind:

Save for a Down Payment

While FHA loans have a lower down payment requirement, saving for a more substantial down payment can reduce your monthly mortgage payments and interest costs.

Improve Credit Score

Even though FHA loans are more forgiving of credit issues, improving your credit score can still open up better loan options.

Pay Off Debt

Reducing your existing debts can improve your debt-to-income ratio and increase your borrowing capacity.

Research FHA-approved Properties

Work with a real estate agent to find properties that are eligible for FHA financing.

Common Pitfalls to Avoid

Overextending Your Budget

Ensure that the monthly mortgage payments fit comfortably within your budget to avoid financial strain.

Neglecting Home Inspection

Always conduct a thorough home inspection to identify any potential issues before finalizing the purchase.

Ignoring Closing Costs

Consider the closing costs when budgeting for your FHA purchase.

Failing to Compare Lenders

Obtain quotes from multiple FHA-approved lenders to find the best terms and rates.

Conclusion

An FHA purchase loan in Florida can be the ideal solution for individuals looking to achieve their dream of homeownership without the burden of a large down payment and stringent credit requirements. With its low down payment, flexible credit criteria, and competitive interest rates, an FHA purchase loan opens doors to homeownership for many aspiring buyers. If you dream of owning a home in Florida, explore the options available through an FHA purchase loan and take the first step towards making that dream a reality.

Frequently Asked Questions (FAQs)

1. What is the minimum credit score required for an FHA purchase in Florida?

The minimum credit score required for an FHA purchase in Florida is typically around 580. However, some lenders may require a higher score for better loan terms.

2. Can I use gift funds for the down payment?

Yes, FHA allows borrowers to use gift funds from family members for the down payment.

3. Are there any property restrictions for FHA loans?

Yes, FHA loans have specific property requirements, such as safety standards and occupancy rules.

4. Can I refinance an FHA purchase loan in the future?

Yes, you can refinance an FHA purchase loan through an FHA streamline refinance or a conventional refinance.

5. How long does it take to process an FHA purchase loan application?

The processing time for an FHA purchase loan can vary, but it typically takes around 30 to 45 days.

Call us 888-958-5382

www.MORTGAGE-WORLD.com LLC is an online mortgage company specializing in FHA loans for first time home buyers.

We look forward to working with you.

Recent Articles

-

Mortgage Rates August 5

Aug 05, 24 04:10 PM

Mortgage Rates August 5, 2024. Rates have gone down recently. Lower rates equals lower mortgage payment. -

Mortgage Rates August 5 2024

Aug 05, 24 03:55 PM

Mortgage Rates August 5 2024 -

Today's FHA Rates 5.00% & 5.875% Conventional Minimum 700 Credit Score

Aug 05, 24 03:48 PM

Today’s historically low 30 year fixed interest rates make now the perfect time to purchase a new home or refinance To be approved at the lowest mortgage rates, you do not need to have the highest cre…

Call Now, Our Staff is Available!

800.516.9166