FHA Loan 2024

As the year 2024 unfolds, prospective homebuyers are keen to explore their options for financing their dream homes. One popular choice that continues to gain attention is the Federal Housing Administration (FHA) loan. FHA loans have been a reliable path to homeownership for many Americans due to their low down payment requirements, flexible credit standards, and government backing. Here's what you need to know about FHA loans in 2024:

1. Low Down Payment Advantage

FHA loans are well-known for their low down payment requirement, which can be as low as 3.5% of the purchase price. This affordability factor remains a key attraction for first-time homebuyers and those who may have limited savings for a down payment.

2. Competitive Interest Rates

FHA loans typically offer competitive interest rates that can rival those of conventional loans. The interest rates may vary based on market conditions, your credit score, and the lender you choose. However, borrowers often find FHA loan rates to be favorable.

3. Flexible Credit Requirements

While a good credit score is an asset, FHA loans are more forgiving when it comes to credit history. Borrowers with credit scores as low as 580 can often qualify for an FHA loan, albeit with slightly different terms. This flexibility makes homeownership accessible to a broader range of individuals and families.

4. Mortgage Insurance Premiums (MIP)

FHA loans do come with Mortgage Insurance Premiums (MIP), which serve as a form of insurance for the lender in case the borrower defaults. It's important to budget for both the upfront MIP (paid at closing) and the ongoing annual MIP (paid monthly). However, the presence of MIP allows for the low down payment option that FHA loans are known for.

5. Property Standards

FHA loans require that the property you intend to purchase meets specific safety and livability standards. While this can ensure you buy a home in good condition, it's essential to be aware of these standards and the potential need for repairs or improvements.

6. Loan Limits

FHA loan limits vary by location and are designed to accommodate different housing markets. In high-cost areas, the loan limits may be higher, allowing borrowers to finance more expensive properties. It's important to check the FHA loan limits in your specific area.

7. Multifamily Properties

FHA loans can be used for multifamily properties, including duplexes, triplexes, and four-unit buildings. However, one unit must be your primary residence.

8. Consult an FHA-Approved Lender

To explore your FHA loan options in 2024, it's advisable to consult with an FHA-approved lender. They can guide you through the application process, help you understand the latest loan terms and policies, and determine if an FHA loan is the right choice for your homeownership goals.

In conclusion, FHA loans continue to be a viable and attractive option for homebuyers in 2024. Their low down payment requirement, competitive interest rates, and flexibility in credit requirements make them accessible to a wide range of buyers. However, it's crucial to be well-informed about the latest FHA loan policies and to work closely with experienced lenders to make the most of this homeownership opportunity.

FHA Loan 2024

Call us 888-958-5382

www.MORTGAGE-WORLD.com LLC is an online mortgage company specializing in FHA loans for first time home buyers.

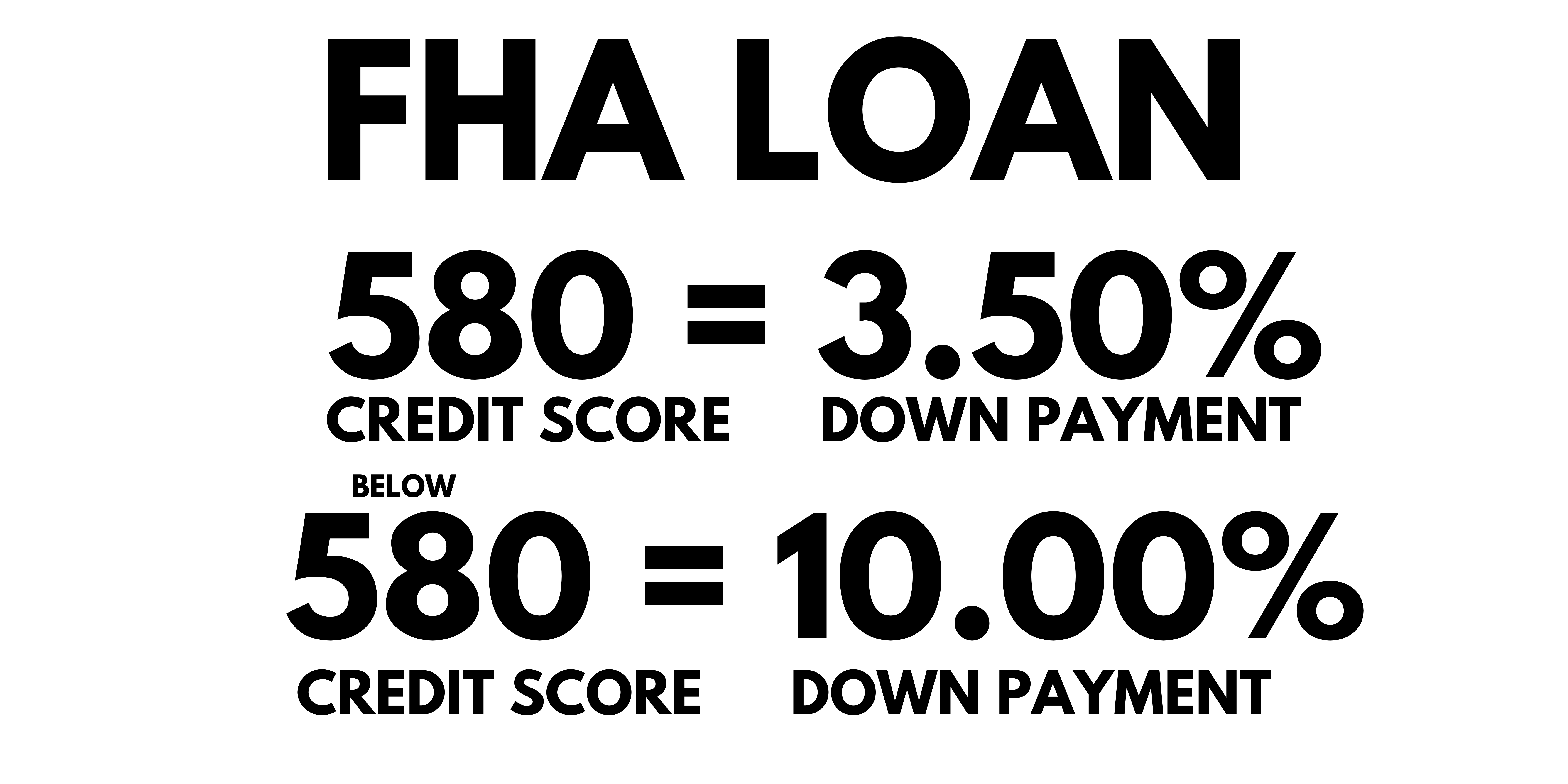

FHA Credit Score needed to buy

a house or refinance

FHA loan requirements new borrowers with less than a 580 credit score will be required to put down at least 10%

FHA requires a minimum credit score of 500 to buy a home or refinance

Bankruptcy

Chapter 7 Bankruptcy at least two years must have elapsed since the discharge date

Foreclosure

Foreclosure must have been resolved for at least 3 years

Government loan: Seasoning is determined by the date the claim was paid

Loans other than Government: Seasoning is determined by the date of sale the lender sold the property

Short Sale

FHA guidelines requires three year past from the date of sale of the property

What documentation will I need?

- W2's or Personal tax returns for 2 years

- Current pay stubs for the past month

- Bank statements for last 2 months (all pages)

- Clear copy of Driver’s License (front and back)

- Clear copy of SS card (front and back)

Call Now, Our Staff is Available

888-958-4228

Recent Articles

-

Mortgage Rates August 5

Aug 05, 24 04:10 PM

Mortgage Rates August 5, 2024. Rates have gone down recently. Lower rates equals lower mortgage payment. -

Mortgage Rates August 5 2024

Aug 05, 24 03:55 PM

Mortgage Rates August 5 2024 -

Today's FHA Rates 5.00% & 5.875% Conventional Minimum 700 Credit Score

Aug 05, 24 03:48 PM

Today’s historically low 30 year fixed interest rates make now the perfect time to purchase a new home or refinance To be approved at the lowest mortgage rates, you do not need to have the highest cre…

Call Now, Our Staff is Available!

800.516.9166