FHA Loan 2024

If you're considering buying a home 2024, you've likely come across the term "FHA loan." FHA loans have been a popular choice for homebuyers for many years, and they continue to be a valuable option in the real estate market. In this comprehensive guide, we'll walk you through everything you need to know about FHA loans 2024. From the basics to the latest updates, we've got you covered.

What is an FHA Loan 2024?

An FHA loan 2024, or Federal Housing Administration loan, is a mortgage program designed to make homeownership more accessible, especially for first-time homebuyers and those with lower credit scores. FHA loans are insured by the federal government, which allows lenders to offer more favorable terms to borrowers.

Why Choose an FHA Loan 2024?

FHA loans 2024 remain an attractive choice for several reasons. First, they typically require lower down payments compared to conventional loans, making homeownership more achievable for many individuals and families. Second, FHA loans often have more lenient credit score requirements, allowing those with less-than-perfect credit histories to qualify.

FHA Loan 2024 Eligibility

Minimum Credit Score Requirements

While FHA loans are known for their flexibility, borrowers should still aim for a credit score of at least 580 to secure a 3.5% down payment option. Those with lower credit scores may still qualify but may need to make a larger down payment.

Down Payment Requirements

One of the standout features of FHA loans is the low down payment requirement. In most cases, you can secure an FHA loan with as little as 3.5% down. This can significantly reduce the upfront costs of buying a home.

Income and Employment Criteria

To be eligible for an FHA loan, you'll need a stable employment history and sufficient income to cover your mortgage payments.

Types of FHA Loans

There are several types of FHA loans to consider, each designed for specific situations.

FHA Purchase Loans

These are the most common type of FHA loans and are meant for purchasing a primary residence.

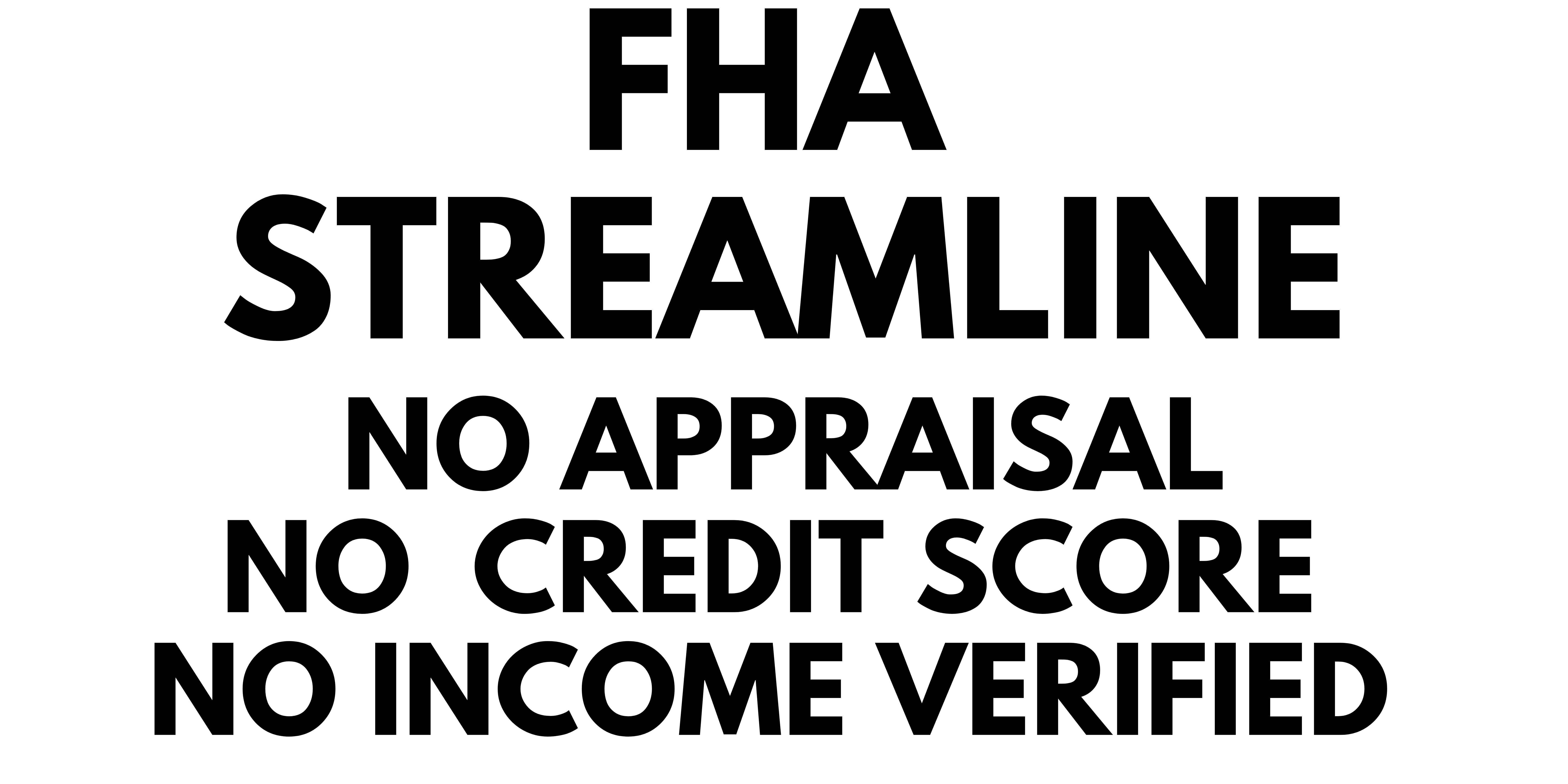

FHA Streamline Refinance

This option allows current FHA borrowers to refinance their existing FHA loan with minimal documentation and underwriting requirements.

FHA 203(k) Loans

If you're planning to buy a fixer-upper, an FHA 203(k) loan can help finance both the purchase and renovation costs.

How to Apply for an FHA Loan 2024

Getting started with an FHA loan is a straightforward process.

Preparation and Documentation

Before applying, gather necessary documents such as proof of income, tax returns, and bank statements.

Selecting a Lender

Choose an FHA-approved lender who can guide you through the application process.

FHA Loan Application Process

Learn about the steps involved in applying for and securing an FHA loan.

FHA Loan Limits 2024

The Federal Housing Administration (FHA) adjusts its loan limits annually to account for changes in housing market conditions and regional variations in home prices. In 2024, FHA loan limits have been set to accommodate a wide range of property values across different areas of the United States. Here's what you need to know about FHA loan limits in 2023:

1. National Base Loan Limit:

- The national base loan limit for FHA-insured loans in 2024 is $766,550 for a single-family home. This means that borrowers can secure an FHA loan of up to $766,550 in most areas of the country without needing a higher-cost area loan limit.

2. High-Cost Area Loan Limits:

- In areas with higher housing costs, FHA loan limits are higher to reflect the increased property values. These limits can vary significantly from one location to another.

- High-cost area loan limits are typically set at 150% of the national base loan limit. For 2024, in high-cost areas, the maximum loan limit can go as high as $1,149,825 for a single-family home.

3. Special Exception Areas:

- There are some areas classified as "special exception" regions where FHA loan limits may exceed the standard high-cost area limits. These exceptions are typically found in places with exceptionally high home prices.

4. Multi-Unit Properties:

- FHA loan limits also vary for multi-unit properties. For duplexes, the loan limit is higher than for single-family homes. For example, the 2024 FHA loan limit for a two-unit property in most areas is $1,474,400.

5. Alaska, Hawaii, Guam, and the U.S. Virgin Islands:

- These regions have higher FHA loan limits due to their unique housing market conditions and elevated property values.

6. Check Local Limits:

- FHA loan limits are specific to each county or metropolitan statistical area (MSA). It's essential for borrowers to check the loan limits in their specific location, as they can vary considerably, even within the same state.

Understanding the FHA loan limits in your area is crucial when considering an FHA loan. These limits determine the maximum loan amount you can borrow with an FHA-insured mortgage. If you plan to purchase a home in a high-cost area, you may be eligible for a larger loan amount, making homeownership more attainable in regions with expensive housing markets.

FHA Loan 2024 Interest Rates

Interest rates play a crucial role in determining the overall cost of financing a home through an FHA loan. FHA loan interest rates are influenced by various factors, and understanding how they work is essential for prospective homebuyers. Here's what you need to know about FHA loan interest rates:

1. Market Conditions:

- FHA loan interest rates are influenced by broader market conditions. They tend to rise and fall with changes in the overall economy, including factors like inflation, unemployment rates, and the health of financial markets.

2. Lender's Discretion:

- Lenders have some discretion in setting the interest rates for FHA loans. While they are influenced by market conditions, lenders may also consider their own operational costs and profit margins when determining the specific rate offered to borrowers.

3. Borrower Credit Score:

- Your credit score plays a significant role in the interest rate you'll be offered. Borrowers with higher credit scores typically qualify for lower interest rates, as they are considered lower-risk borrowers.

4. Down Payment:

- The amount of your down payment can also impact your interest rate. A larger down payment may lead to a lower interest rate, as it reduces the lender's risk.

5. Loan Term:

- The term of your FHA loan can affect your interest rate. Typically, shorter-term loans (e.g., 15-year) may have lower interest rates compared to longer-term loans (e.g., 30-year).

6. Market Rate vs. Lock Rate:

- Borrowers have the option to either lock in the current interest rate when they apply for the loan or float with the market rate until closing. Locking in the rate can provide certainty but may not allow you to take advantage of potential rate decreases.

7. Mortgage Points:

- Borrowers can often choose to pay "points" upfront to reduce their interest rate. Each point is typically equal to 1% of the loan amount. Paying points can lower your monthly mortgage payments but requires an initial upfront cost.

8. Government Influence:

- FHA loans are government-backed, and FHA itself does not set interest rates. However, government policies and economic conditions can indirectly impact FHA loan rates.

9. Competitive Rates:

- FHA loans generally offer competitive interest rates. Borrowers can compare rates from different lenders to find the most favorable terms.

FHA Mortgage Insurance Premiums

FHA Mortgage Insurance Premiums (MIP) are a critical component of Federal Housing Administration (FHA) loans. They are designed to protect lenders from financial losses in case borrowers default on their loans. Understanding MIP is essential for anyone considering an FHA loan. Here's what you need to know:

1. Upfront Mortgage Insurance Premium (UFMIP):

- Borrowers are required to pay an Upfront Mortgage Insurance Premium (UFMIP) at the time of closing on an FHA loan. This premium is a one-time, upfront cost and is typically financed into the loan amount.

- The UFMIP rate is a percentage of the loan amount and can vary but is currently set at 1.75% of the base loan amount.

2. Annual Mortgage Insurance Premium (MIP):

- In addition to the UFMIP, FHA borrowers are also required to pay an Annual Mortgage Insurance Premium (MIP). Unlike the UFMIP, the MIP is paid annually over the life of the loan.

- The MIP rate is determined by various factors, including the loan term, the loan-to-value ratio (LTV), and whether the borrower's down payment is less than 10% or 10% or more. These factors affect how long the MIP must be paid and at what rate.

- For most FHA loans with a down payment of less than 10% and a loan term greater than 15 years, the MIP must be paid for the entire loan term. For loans with a down payment of 10% or more, the MIP can be canceled after 11 years.

3. MIP Rates:

- MIP rates can change over time and are subject to adjustments by the FHA. Borrowers should check with their lender to determine the current MIP rates and how they apply to their specific loan.

4. Cancellation of MIP:

- For FHA loans with a down payment of 10% or more, borrowers can request the cancellation of MIP once they reach a certain threshold. This typically requires the LTV ratio to fall below 78%, and the borrower must have made MIP payments for at least 11 years.

- Loans with a down payment of less than 10% will have MIP for the entire loan term, regardless of LTV.

5. Purpose of MIP:

- MIP serves to protect lenders in case of borrower default, allowing lenders to offer low down payment options and more flexible credit requirements.

- While MIP adds to the overall cost of an FHA loan, it enables borrowers who might not qualify for conventional loans to access homeownership.

6. Impact on Borrowers:

- Borrowers should be aware that MIP adds to the overall cost of homeownership. It increases monthly mortgage payments, making it important for borrowers to budget accordingly.

FHA Loan 2024 Pros and Cons

Pros of FHA Loan 2024

- Low Down Payment: One of the most significant advantages of FHA loans is the low down payment requirement. Borrowers can often secure a loan with as little as 3.5% down, making homeownership more accessible.

- Lower Credit Score Requirements: FHA loans are known for their flexibility when it comes to credit scores. While a credit score of at least 580 is recommended, borrowers with lower scores may still qualify.

- Competitive Interest Rates: FHA loans typically offer competitive interest rates, which can result in lower monthly mortgage payments.

- Assumable Loans: FHA loans are assumable, meaning that if you decide to sell your home, the new buyer can take over your existing FHA loan, potentially making your home more attractive to buyers.

- Favorable Debt-to-Income Ratios: FHA loans often allow for higher debt-to-income ratios, which means you can qualify even if you have other outstanding debts.

- Financial Assistance: Some FHA borrowers may be eligible for down payment assistance programs, further reducing the upfront costs of homeownership.

- Fixed or Adjustable Rates: FHA loans offer both fixed-rate and adjustable-rate options, allowing borrowers to choose the one that suits their financial goals.

Cons of FHA Loan 2024

- Mortgage Insurance Premiums: FHA loans require both an upfront mortgage insurance premium (UFMIP) and an annual mortgage insurance premium (MIP). These premiums can add to the overall cost of the loan.

- Loan Limits: FHA loan limits vary by location and are subject to change. In some high-cost areas, the loan limits may not be sufficient for more expensive homes.

- Property Requirements: FHA loans have specific property requirements, and the home you intend to purchase must meet these standards. This can limit your options in the housing market.

- Residency Requirement: FHA loans are meant for primary residences, so they cannot be used for investment properties or vacation homes.

- Credit History Considerations: While FHA loans are more forgiving of credit issues, a history of bankruptcies or foreclosures may still impact your eligibility.

- Complex Appraisal Process: FHA appraisals can be more detailed and stringent, potentially leading to additional requirements or repairs before loan approval.

- Limited Financial Flexibility: FHA loans may have restrictions on certain types of financial transactions, such as seller concessions.

Tips for a Successful FHA Loan 2024 Application

Securing an FHA loan 2024 can be a straightforward process if you follow these tips to ensure a successful application:

- Check Your Credit Report: Start by obtaining a copy of your credit report from all three major credit bureaus. Review it for any errors or discrepancies and address them before applying for the loan.

- Improve Your Credit Score: While FHA loans have lower credit score requirements, working to improve your credit score can help you qualify for better loan terms. Pay down outstanding debts and make payments on time.

- Save for a Down Payment: While FHA loans offer low down payment options, it's still essential to save for a down payment and closing costs. A larger down payment can help lower your monthly mortgage insurance premiums.

- Gather Required Documentation: FHA loan applications require documentation of your financial history. Be prepared to provide proof of income, tax returns, bank statements, and other relevant financial records.

- Get Preapproved: Before house hunting, get preapproved for an FHA loan. Preapproval demonstrates your seriousness as a buyer and helps you understand your budget.

- Choose an FHA-Approved Lender: Work with a lender who is experienced with FHA loans and is approved by the Federal Housing Administration. They can guide you through the application process.

- Understand Debt-to-Income Ratio: FHA loans have specific debt-to-income ratio requirements. Calculate your debt-to-income ratio and make adjustments if necessary to meet FHA guidelines.

- Budget for Mortgage Insurance: Be aware of the upfront mortgage insurance premium (UFMIP) and annual mortgage insurance premium (MIP) costs. Include these in your budget calculations.

- Review Property Requirements: Ensure that the property you intend to purchase meets FHA standards. The property should be your primary residence, and it should meet safety and livability requirements.

- Plan for Appraisal and Inspection: FHA loans require a property appraisal and inspection. Be prepared for potential repair or improvement requests based on the appraiser's findings.

- Maintain Stable Employment: FHA lenders look for stable employment and income history. Avoid changing jobs or careers shortly before applying for the loan.

- Don't Open New Credit Accounts: Avoid opening new credit accounts or taking on additional debt while your FHA loan application is in process. This can affect your creditworthiness.

- Be Honest and Complete: Fill out your loan application honestly and completely. Providing accurate information is crucial for a successful application.

- Stay Informed: Keep up with the latest FHA loan policies and requirements, as they may change over time. Your lender can provide updates and guidance.

- Seek Professional Advice: If you're unsure about any aspect of the FHA loan application process, consider seeking advice from a financial advisor or housing counselor.

FHA Loan 2024 Myths Debunked

FHA Loan 2024 Myths Debunked

FHA loans are a popular choice for many homebuyers, but they are sometimes surrounded by misconceptions and myths. Let's debunk some of the most common myths associated with FHA loans:

Myth 1: FHA Loans Are Only for First-Time Homebuyers Debunked: This is a common misconception. While FHA loans are popular among first-time homebuyers, they are available to repeat buyers as well. As long as you meet the eligibility criteria, you can use an FHA loan to purchase your next home.

Myth 2: FHA Loans Have High Interest Rates Debunked: FHA loans often have competitive interest rates that are on par with or even lower than conventional loans. The interest rate you receive depends on factors like your credit score and the current market conditions.

Myth 3: FHA Loans Require a 20% Down Payment Debunked: One of the most significant advantages of FHA loans is the low down payment requirement. While some other loan programs may require a 20% down payment, FHA loans typically require as little as 3.5% down. This makes homeownership more accessible.

Myth 4: FHA Loans Have Strict Credit Score Requirements Debunked: While FHA loans do have credit score requirements, they are more lenient than those of many conventional loans. You can often qualify for an FHA loan with a credit score as low as 580. Borrowers with lower credit scores may still be eligible, albeit with slightly different terms.

Myth 5: FHA Loans Are Only for Low-Income Borrowers Debunked: FHA loans are not limited to low-income borrowers. They are designed to assist a wide range of individuals and families in achieving homeownership. Your income will be considered during the application process, but there is no strict income limit for FHA loan eligibility.

Myth 6: FHA Loans Are Risky for Lenders Debunked: FHA loans are backed by the Federal Housing Administration, which means they are insured against default. This insurance reduces the risk for lenders, making them more willing to approve loans for borrowers with lower credit scores and smaller down payments.

Myth 7: FHA Loans Are Only for Single-Family Homes Debunked: While FHA loans are commonly used for single-family homes, they can also be used to purchase multifamily properties (up to four units) as long as you plan to live in one of the units as your primary residence.

Myth 8: FHA Loans Are Slow and Complicated Debunked: FHA loans are not inherently slower or more complicated than other loan types. The speed and ease of the loan process depend on factors such as your preparedness, the lender you choose, and the current market conditions.

Myth 9: FHA Loans Have Excessive Closing Costs Debunked: Closing costs for FHA loans can vary depending on the lender and the location, but they are not inherently higher than those for other types of loans. Borrowers can negotiate with lenders to understand and potentially reduce closing costs.

Myth 10: FHA Loans Are Only for Low-Value Homes Debunked: FHA loan limits vary by location and are designed to accommodate a range of home values. In many areas, FHA loan limits are sufficient to purchase homes at various price points.

The FHA Loan 2024 Appraisal Process

The FHA appraisal process is a crucial step in obtaining an FHA loan and ensuring that the property you intend to purchase meets specific safety and livability standards set by the Federal Housing Administration. The appraisal is conducted to protect both the buyer and the lender, ensuring that the property is worth the loan amount and meets FHA requirements.

1. Selection of an FHA-Approved Appraiser

To initiate the FHA appraisal process, the lender selects an FHA-approved appraiser. These appraisers are certified by the FHA and are knowledgeable about the unique requirements and standards that must be met.

2. Property Inspection

The appraiser conducts a thorough inspection of the property. This inspection includes a visual examination of the home's interior and exterior. The appraiser looks for various factors, including:

- The overall condition of the property, including structural integrity.

- Any health or safety hazards, such as faulty wiring or plumbing.

- Compliance with local building codes.

- The functionality of essential systems, like heating, cooling, and plumbing.

- The presence of lead-based paint, which is a concern in homes built before 1978.

3. Comparative Market Analysis

The appraiser also performs a comparative market analysis (CMA) to determine the property's fair market value. They assess recent sales of similar properties in the area to establish a benchmark for the property's worth. This step ensures that the property's value aligns with the loan amount requested by the buyer.

4. Reporting and Documentation

The appraiser compiles their findings into an FHA appraisal report. This detailed document includes:

- A description of the property and its condition.

- Any required repairs or improvements to meet FHA standards.

- The estimated fair market value of the property.

- Comparisons to recent sales of similar properties.

- Photos of the property, highlighting any issues or areas of concern.

5. Required Repairs or Improvements

If the appraiser identifies any deficiencies or issues during the inspection, they will note these in the appraisal report. The lender may require the buyer to address these issues before closing on the loan. Common repairs may include fixing structural defects, addressing safety hazards, or resolving issues with essential systems.

6. Lender Review

Once the appraisal report is complete, the lender reviews it to ensure that the property meets FHA requirements and that the loan amount is justified by the property's value. If the property passes the appraisal and meets all criteria, the loan can proceed to the closing stage.

7. Buyer Notification

The buyer receives a copy of the FHA appraisal report, including any required repairs or improvements. They may negotiate with the seller to address these issues or determine how they will be resolved before closing.

8. Final Approval

After any necessary repairs are made and the property meets FHA standards, the loan receives final approval. The buyer can proceed with the purchase and closing process.

FHA Loan 2024 vs. Conventional Loan 2024

When it comes to financing your home purchase, you'll likely encounter two primary options: FHA loans and conventional loans. Each has its advantages and considerations, and choosing the right one depends on your financial situation, credit history, and homeownership goals. Let's compare FHA loans and conventional loans to help you make an informed decision.

FHA Loan 2024

1. Down Payment:

- Pros: FHA loans offer a low down payment requirement, typically as low as 3.5% of the purchase price. This makes homeownership more accessible, especially for first-time buyers.

- Cons: A lower down payment means higher upfront mortgage insurance premiums (UFMIP) and ongoing annual mortgage insurance premiums (MIP).

2. Credit Score Requirements:

- Pros: FHA loans are more forgiving of lower credit scores. Borrowers with credit scores as low as 580 may qualify.

- Cons: Borrowers with lower credit scores may face higher interest rates.

3. Debt-to-Income Ratio:

- Pros: FHA loans often allow for higher debt-to-income ratios, making it easier to qualify even if you have other outstanding debts.

- Cons: Higher debt ratios may lead to higher interest rates.

4. Property Standards:

- Pros: FHA loans have property standards that promote safety and livability.

- Cons: Properties must meet these standards, which may limit your choices in the housing market.

5. Mortgage Insurance:

- Pros: FHA loans require mortgage insurance, but it's backed by the government, which may result in lower premiums.

- Cons: Borrowers must pay UFMIP and MIP throughout the life of the loan.

Conventional Loan 2024

1. Down Payment:

- Pros: Conventional loans offer flexibility in down payment options. You can choose a down payment as low as 3% or as high as you can afford.

- Cons: A lower down payment often means higher interest rates and private mortgage insurance (PMI) requirements.

2. Credit Score Requirements:

- Pros: Conventional loans may offer more favorable terms for borrowers with excellent credit scores.

- Cons: Higher credit scores are often required for the best interest rates.

3. Debt-to-Income Ratio:

- Pros: Conventional loans may have stricter debt-to-income ratio requirements, promoting responsible borrowing.

- Cons: Stricter debt ratios may limit loan eligibility for some borrowers.

4. Property Standards:

- Pros: Conventional loans have fewer property restrictions, allowing for a broader range of property choices.

- Cons: Borrowers may need to cover the cost of additional inspections or repairs.

5. Mortgage Insurance:

- Pros: Conventional loans may have lower mortgage insurance costs, especially if you make a larger down payment.

- Cons: PMI may be required until you reach a certain level of equity in the home.

Which Loan Is Right for You?

- Choose an FHA Loan If: You have a lower credit score, a limited down payment, and need a more accessible path to homeownership. FHA loans are ideal for first-time buyers and those with credit challenges.

- Choose a Conventional Loan If: You have a strong credit history, can make a larger down payment, and seek more flexible terms. Conventional loans offer greater options but may require higher credit scores and financial stability.

Recent Changes in FHA Loan 2024 Policies

The Federal Housing Administration (FHA) periodically updates its policies and guidelines to adapt to the evolving housing market and economic conditions. As of the most recent changes, here are some key updates to FHA loan policies:

1. Higher Loan Limits:

- Change: FHA loan limits have increased in many areas, allowing borrowers to qualify for larger loan amounts.

- Impact: This change benefits homebuyers in higher-cost regions by providing increased access to FHA financing for more expensive properties.

2. Credit Score Requirements:

- Change: FHA has introduced some adjustments to credit score requirements. While lower credit scores are still accepted, borrowers with lower scores may face slightly higher interest rates.

- Impact: Borrowers with lower credit scores may still qualify for FHA loans, but they should be prepared for potential interest rate adjustments.

3. Mortgage Insurance Premiums (MIP):

- Change: FHA MIP rates have been adjusted. Borrowers may see changes in the upfront mortgage insurance premium (UFMIP) and annual mortgage insurance premium (MIP) costs.

- Impact: These changes affect the overall cost of FHA loans, potentially increasing upfront expenses and ongoing monthly payments.

4. Energy-Efficient Home Improvements:

- Change: FHA has expanded its financing options for energy-efficient home improvements. Borrowers can now include the cost of certain energy-efficient upgrades in their FHA loans.

- Impact: This change encourages environmentally friendly improvements and allows borrowers to finance energy-efficient enhancements when purchasing or refinancing a home.

5. Student Loan Debt Calculation:

- Change: FHA has updated the way it calculates monthly payments for student loans. This change may affect the debt-to-income ratios of borrowers with student loan debt.

- Impact: Borrowers with student loans may see adjustments in their debt-to-income ratios, potentially impacting loan eligibility and terms.

6. Appraisal Requirements:

- Change: FHA appraisals have become more focused on property safety and livability standards. Appraisers may pay increased attention to certain property conditions.

- Impact: Properties must meet FHA standards, which may lead to repair or improvement requirements before loan approval.

7. Documentation and Verification:

- Change: FHA lenders are implementing stricter documentation and verification procedures for income, employment, and other financial aspects.

- Impact: Borrowers should be prepared to provide comprehensive documentation to support their loan applications.

Conclusion

In 2023, FHA loans remain a valuable tool for prospective homeowners. Their accessibility, low down payment requirements, and flexibility make them an excellent choice for many. If you're considering purchasing a home this year, exploring the possibilities of an FHA loan could be the key to unlocking your homeownership dreams.

FAQs

1. Can I get an FHA loan with a low credit score in 2024?

Yes, it's possible to qualify for an FHA loan with a low credit score, but you may need to make a larger down payment.

2. What are the current FHA loan limits for my area?

FHA loan limits vary by location, so check with your lender to find out the specific limits in your area for 2024.

3. Is mortgage insurance required for the entire loan term with an FHA loan?

No, you can request the removal of mortgage insurance once you've reached a certain level of equity in your home.

4. How long does the FHA loan application process typically take?

The timeframe can vary, but it usually takes a few weeks from application to closing.

5. Are FHA loans only for first-time homebuyers?

No, FHA loans are available to both first-time homebuyers and repeat buyers who meet the eligibility criteria.

Call us 888-958-5382

www.MORTGAGE-WORLD.com LLC is an online mortgage company specializing in FHA loans for first time home buyers.

FHA Credit Score needed to buy

a house or refinance

FHA loan requirements new borrowers with less than a 580 credit score will be required to put down at least 10%

FHA requires a minimum credit score of 500 to buy a home or refinance

Bankruptcy

Chapter 7 Bankruptcy at least two years must have elapsed since the discharge date

Foreclosure

Foreclosure must have been resolved for at least 3 years

Government loan: Seasoning is determined by the date the claim was paid

Loans other than Government: Seasoning is determined by the date of sale the lender sold the property

Short Sale

FHA guidelines requires three year past from the date of sale of the property

What documentation will I need?

- W2's or Personal tax returns for 2 years

- Current pay stubs for the past month

- Bank statements for last 2 months (all pages)

- Clear copy of Driver’s License (front and back)

- Clear copy of SS card (front and back)

Call Now, Our Staff is Available

888-958-4228

Recent Articles

-

Mortgage Rates August 5

Aug 05, 24 04:10 PM

Mortgage Rates August 5, 2024. Rates have gone down recently. Lower rates equals lower mortgage payment. -

Mortgage Rates August 5 2024

Aug 05, 24 03:55 PM

Mortgage Rates August 5 2024 -

Today's FHA Rates 5.00% & 5.875% Conventional Minimum 700 Credit Score

Aug 05, 24 03:48 PM

Today’s historically low 30 year fixed interest rates make now the perfect time to purchase a new home or refinance To be approved at the lowest mortgage rates, you do not need to have the highest cre…

Call Now, Our Staff is Available!

800.516.9166