Florida Mortgage Brokers: Simplifying Your Path to Homeownership

Are you considering buying a home in Florida? Securing a mortgage is an essential step in the homebuying process, and partnering with a reputable mortgage broker can make all the difference. Florida mortgage brokers specialize in connecting homebuyers with lenders, ensuring that they find the most suitable mortgage options available. In this article, we will explore the role of Florida mortgage brokers, their benefits, and how to choose the right broker for your needs.

- Understanding the Role of Florida Mortgage Brokers

- The Benefits of Working with a Mortgage Broker

- How to Choose a Florida Mortgage Broker

- Mortgage Broker Fees and Compensation

- Common Misconceptions About Mortgage Brokers

- The Mortgage Process: Step-by-Step

- Preparing for Your Mortgage Application

- Document Requirements for a Mortgage

- Mortgage Types Available in Florida

- Finding the Best Mortgage Rates

- Understanding Mortgage Closing Costs

- Frequently Asked Questions (FAQs)

- Conclusion

Florida mortgage brokers act as intermediaries between homebuyers and lenders. They work diligently to understand the unique financial situation of each client and match them with the most suitable mortgage products. These professionals have access to a wide range of lenders, including banks, credit unions, and private lenders, allowing them to provide borrowers with a variety of options.

2. The Benefits of Working with a Mortgage Broker

Partnering with a mortgage broker offers several advantages over approaching lenders directly. Here are some key benefits:

- a) Expertise and Market Knowledge

- b) Access to Multiple Lenders

- c) Personalized Solutions

- d) Time and Cost Savings

Florida mortgage brokers are well-versed in the local housing market and have a deep understanding of current mortgage trends and regulations. They leverage their expertise to guide borrowers through the complex mortgage landscape, making the process smoother and less overwhelming.

Unlike banks or credit unions that offer their own mortgage products, mortgage brokers have connections with numerous lenders. This access allows them to compare multiple loan options, including interest rates, terms, and repayment plans, to find the most favorable terms for their clients.

Every homebuyer's financial situation is unique, and mortgage brokers recognize this. They take the time to assess individual circumstances, such as credit history, income, and future financial goals, to tailor the mortgage options accordingly. This personalized approach increases the likelihood of securing a mortgage that fits the borrower's needs.

Navigating the mortgage process can be time-consuming and tedious. Mortgage brokers streamline the process by handling paperwork, liaising with lenders, and managing the overall application process. Their expertise and efficient workflows save borrowers both time and money.

3. How to Choose a Florida Mortgage Broker

Selecting the right mortgage broker is crucial for a successful homebuying experience. Consider the following factors when choosing a Florida mortgage broker:

- a) Reputation and Experience

- b) Licensing and Credentials

- c) Range of Mortgage Products

- d) Communication and Accessibility

Look for mortgage brokers with a solid reputation and extensive experience in the industry. Read online reviews, check testimonials, and ask for recommendations from friends, family, or real estate agents. A reputable broker will have a track record of satisfied clients and successful mortgage closings.

Ensure that the mortgage broker you choose is licensed and regulated by the appropriate authorities. A valid license demonstrates their adherence to professional standards and ethics. You can verify a broker's credentials by checking with the Florida Office of Financial Regulation.

Evaluate the breadth of mortgage products a broker offers. The more options available, the higher the chances of finding a mortgage that aligns with your financial goals. Inquire about the types of mortgages they specialize in, such as fixed-rate mortgages, adjustable-rate mortgages, FHA loans, or VA loans.

Open and clear communication is vital throughout the mortgage process. Choose a mortgage broker who is responsive, readily available to address your concerns, and keeps you informed about the progress of your application. Prompt communication ensures a smoother and more efficient experience.

4. Mortgage Broker Fees and Compensation

Florida mortgage brokers are typically compensated through lender-paid commissions or borrower-paid fees. It's essential to understand the fee structure before engaging a broker. Ask about their fees, including origination fees, application fees, or any other charges involved. Clarify whether they receive incentives from lenders for recommending specific products.

5. Common Misconceptions About Mortgage Brokers

Several misconceptions surround mortgage brokers. Let's debunk some of the most common ones:

- a) Mortgage Brokers Increase the Cost of a Mortgage

- b) Mortgage Brokers Only Offer High-Interest Loans

- c) It's Better to Approach Lenders Directly

Contrary to popular belief, mortgage brokers don't increase the cost of a mortgage. In fact, they often negotiate competitive interest rates and terms on behalf of their clients, potentially saving them money over the long term.

Mortgage brokers have access to a wide network of lenders, including those offering competitive interest rates. They work diligently to find the best loan options available, tailored to the borrower's financial situation and requirements.

While it's possible to approach lenders directly, working with a mortgage broker provides several advantages. Brokers offer personalized solutions, access to multiple lenders, and expert guidance throughout the mortgage process.

6. The Mortgage Process: Step-by-Step

The mortgage process can seem overwhelming, especially for first-time homebuyers. Here's a step-by-step overview:

- Mortgage Pre-Approval: Get pre-approved for a mortgage to determine your budget and strengthen your offer when making an offer on a home.

- Mortgage Application: Complete a mortgage application, providing accurate and comprehensive information about your financial situation.

- Documentation Submission: Gather and submit the required documents, including income verification, bank statements, tax returns, and identification.

- Mortgage Processing: The mortgage broker will review your application, order an appraisal, and coordinate with the lender to ensure a smooth processing of your mortgage.

- Underwriting: The lender's underwriting team will assess your application, verify the information, and evaluate the risk associated with granting you a mortgage.

- Mortgage Approval: Upon successful underwriting, you will receive a mortgage approval letter outlining the terms and conditions of the loan.

- Closing: The final step involves signing the necessary documents, paying closing costs, and officially transferring ownership of the property.

7. Preparing for Your Mortgage Application

Before applying for a mortgage, it's important to prepare your financials. Here are some steps to take:

- Review your credit report and address any errors or outstanding debts.

- Save for a down payment to improve your loan options and reduce the mortgage amount.

- Pay off existing debts or reduce their balances to improve your debt-to-income ratio.

- Avoid major financial changes, such as job changes or large purchases, during the mortgage application process.

8. Document Requirements for a Mortgage

When applying for a mortgage, you will need to provide certain documents. Common requirements include:

- Proof of income (pay stubs, W-2 forms, or tax returns)

- Bank statements

- Identification documents (driver's license, passport, etc.)

- Proof of assets (investments, real estate holdings, etc.)

- Employment verification

9. Mortgage Types Available in Florida

Florida offers various mortgage options to suit different homebuyers' needs. These include:

- Conventional mortgages

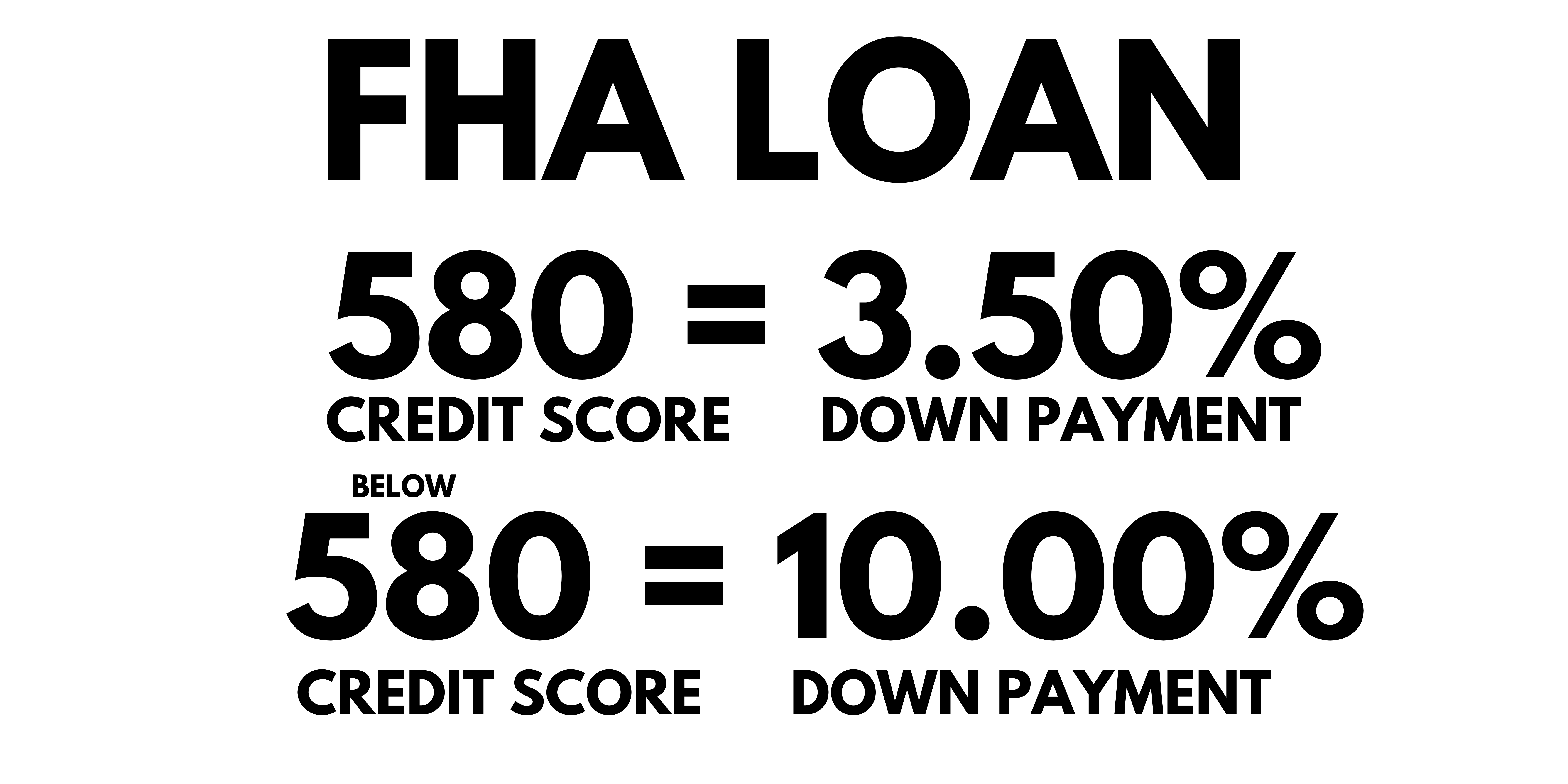

- FHA loans

- VA loans

- USDA loans

- Jumbo loans

Each mortgage type has its own eligibility criteria, down payment requirements, and lending terms. A mortgage broker can help you understand the nuances of each option and choose the one that aligns with your goals.

10. Finding the Best Mortgage Rates

Mortgage rates can vary based on several factors, including the loan type, loan term, credit score, and market conditions. To find the best mortgage rates:

- Compare rates from multiple lenders.

- Improve your credit score by paying bills on time and reducing outstanding debts.

- Consider the length of the loan term and its impact on interest rates.

- Consult with a mortgage broker who can leverage their network to find competitive rates.

11. Understanding Mortgage Closing Costs

Closing costs are fees and expenses associated with finalizing a mortgage. They typically range from 2% to 5% of the loan amount and can include:

- Appraisal fees

- Title insurance

- Attorney fees

- Loan origination fees

- Home inspection fees

- Property taxes

Ensure you have a clear understanding of the closing costs involved before proceeding with your mortgage application. Your mortgage broker can provide detailed information specific to your situation.

Frequently Asked Questions (FAQs)

- What is the role of a mortgage broker? A mortgage broker acts as an intermediary between homebuyers and lenders, helping borrowers find suitable mortgage options and facilitating the application process.

- How does a mortgage broker get paid? Mortgage brokers are compensated through lender-paid commissions or borrower-paid fees. The specific fee structure varies depending on the broker and the loan product.

- Are mortgage brokers regulated in Florida? Yes, mortgage brokers in Florida are regulated by the Florida Office of Financial Regulation. They must obtain the necessary licenses to operate legally.

- Can a mortgage broker help with bad credit? Yes, mortgage brokers can assist borrowers with bad credit by connecting them with lenders specializing in credit-challenged situations. They explore alternative options to increase the chances of approval.

- How long does the mortgage process typically take? The mortgage process duration can vary depending on several factors, including the complexity of the application, the responsiveness of the borrower, and the lender's efficiency. On average, it takes 30 to 45 days to close a mortgage.

Conclusion

Partnering with a Florida mortgage broker can simplify the homebuying journey by providing expert guidance, access to multiple lenders, and personalized mortgage solutions. These professionals streamline the process, saving you time, money, and potential frustration. Remember to research and select a reputable mortgage broker who understands your unique financial needs and goals.

Unlock the doors to homeownership in Florida by seeking the assistance of a reliable and knowledgeable mortgage broker today!

Call us 888-958-5382

www.MORTGAGE-WORLD.com LLC is an online mortgage company specializing in FHA loans for first time home buyers.

We look forward to working with you.

Recent Articles

-

Mortgage Rates August 5

Aug 05, 24 04:10 PM

Mortgage Rates August 5, 2024. Rates have gone down recently. Lower rates equals lower mortgage payment. -

Mortgage Rates August 5 2024

Aug 05, 24 03:55 PM

Mortgage Rates August 5 2024 -

Today's FHA Rates 5.00% & 5.875% Conventional Minimum 700 Credit Score

Aug 05, 24 03:48 PM

Today’s historically low 30 year fixed interest rates make now the perfect time to purchase a new home or refinance To be approved at the lowest mortgage rates, you do not need to have the highest cre…

Call Now, Our Staff is Available!

800.516.9166