The Complete Guide to Home Buying | Expert Tips and Resources

Are you thinking about buying a home? Whether you're a first-time homebuyer or looking to upgrade your living space, the home buying process can be daunting. But with the right knowledge and guidance, you can make informed decisions and find the perfect home for you. In this complete guide to home buying, our experts share their tips and insights on everything you need to know, from understanding the home buying process to choosing the right mortgage and negotiating a fair price.

Assessing Your Needs and Budget

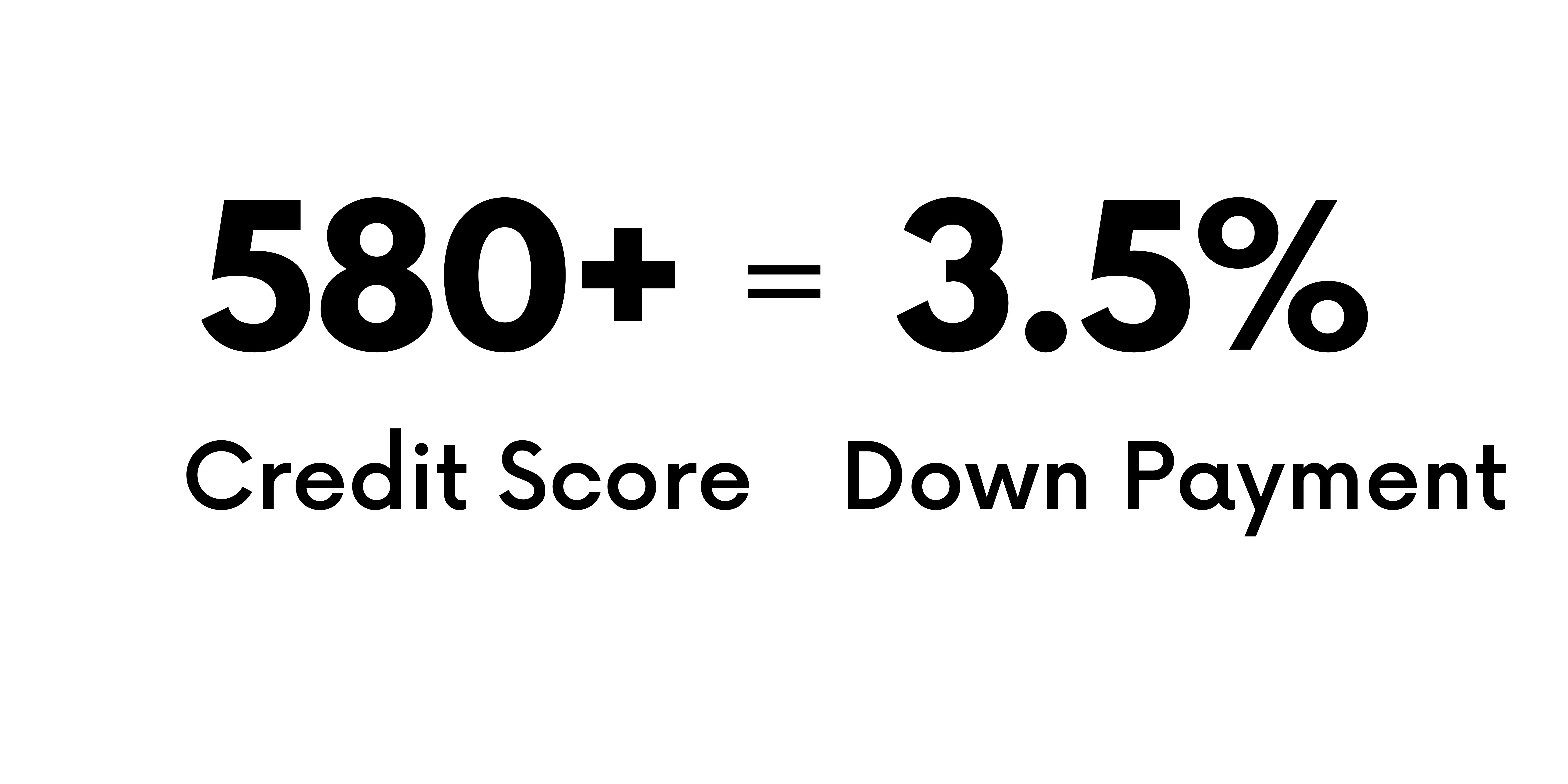

The first step in the home buying process is to assess your needs and budget. In this section, we'll discuss how to determine what you're looking for in a home and how much you can afford to spend. We'll also cover the financial considerations involved in home buying, such as down payments, closing costs, and mortgage payments.

Choosing the Right Mortgage

Once you have a budget in mind, the next step is to choose the right mortgage. In this section, we'll discuss the different types of mortgages available and help you choose the right one for your needs. We'll also cover the pre-approval process and how it can help you secure a better deal on your home.

Searching for Homes

Now that you have a budget and a mortgage in place, it's time to start searching for homes. In this section, we'll share tips and strategies for finding the perfect home for you, from scouting neighborhoods to working with a real estate agent. We'll also discuss home inspections and how to spot potential issues that could affect the value of the home.

Making an Offer

Once you've found a home you love, it's time to make an offer. In this section, we'll discuss the art of negotiation and how to get the best possible deal on your home. We'll cover topics such as making an offer, handling counteroffers, and understanding the market conditions that can affect the final price.

Closing the Deal

Congratulations! You've made an offer and it's been accepted. Now it's time to close the deal. In this section, we'll discuss the final steps in the home buying process, such as closing costs, title insurance, and the final walkthrough. We'll also provide tips on how to make the closing process as smooth and stress-free as possible.

FAQs

In this section, we'll answer some of the most frequently asked questions about home buying, such as how to improve your credit score, what to do if your offer is rejected, and how to prepare for the closing process.

Conclusion

We hope this complete guide to home buying has provided you with the knowledge and resources you need to make informed decisions throughout the home buying process. Remember, buying a home is a big decision, but with the right guidance and expertise, you can find the perfect home for you and your family. If you have any further questions or are ready to take the next step, don't hesitate to reach out to our team of experts. We're here to help you find your dream home.

Call us 800.516.9166

www.MORTGAGE-WORLD.com LLC is an online mortgage company specializing in FHA loans for first time home buyers.

We look forward to working with you.

Call us 888-958-5382

www.MORTGAGE-WORLD.com LLC is an online mortgage company specializing in FHA loans for first time home buyers.

We look forward to working with you.

Recent Articles

-

Mortgage Rates August 5

Aug 05, 24 04:10 PM

Mortgage Rates August 5, 2024. Rates have gone down recently. Lower rates equals lower mortgage payment. -

Mortgage Rates August 5 2024

Aug 05, 24 03:55 PM

Mortgage Rates August 5 2024 -

Today's FHA Rates 5.00% & 5.875% Conventional Minimum 700 Credit Score

Aug 05, 24 03:48 PM

Today’s historically low 30 year fixed interest rates make now the perfect time to purchase a new home or refinance To be approved at the lowest mortgage rates, you do not need to have the highest cre…

Call Now, Our Staff is Available!

800.516.9166

Recent Articles

-

Mortgage Rates August 5

Aug 05, 24 04:10 PM

Mortgage Rates August 5, 2024. Rates have gone down recently. Lower rates equals lower mortgage payment. -

Mortgage Rates August 5 2024

Aug 05, 24 03:55 PM

Mortgage Rates August 5 2024 -

Today's FHA Rates 5.00% & 5.875% Conventional Minimum 700 Credit Score

Aug 05, 24 03:48 PM

Today’s historically low 30 year fixed interest rates make now the perfect time to purchase a new home or refinance To be approved at the lowest mortgage rates, you do not need to have the highest cre…