Is It Hard to Qualify for a Mortgage Cash Out Refinance?

In today's unpredictable economic climate, financial stability is a top priority for homeowners. A cash out refinance can provide a much-needed financial boost, allowing homeowners to tap into their home equity. However, the burning question is, "Is it hard to qualify for a mortgage cash out refinance?" In this article, we'll delve into the intricacies of this process to provide you with a comprehensive understanding of what it takes to qualify.

A cash out refinance is a financial maneuver where a homeowner refinances their mortgage, taking out a loan for more than their current balance. The excess amount can be used for various purposes, such as home improvements, debt consolidation, or other financial needs.

What is a Mortgage Cash Out Refinance?

Before we explore the qualification process, let's clarify the concept of a mortgage cash out refinance. In a cash out refinance, the homeowner replaces their existing mortgage with a new, larger one, receiving the difference in cash. This cash is often used for specific financial goals.

Qualifying for a Mortgage Cash Out Refinance

Qualifying for a mortgage cash out refinance may seem challenging, but it's not impossible. Several key factors come into play when lenders assess your eligibility.

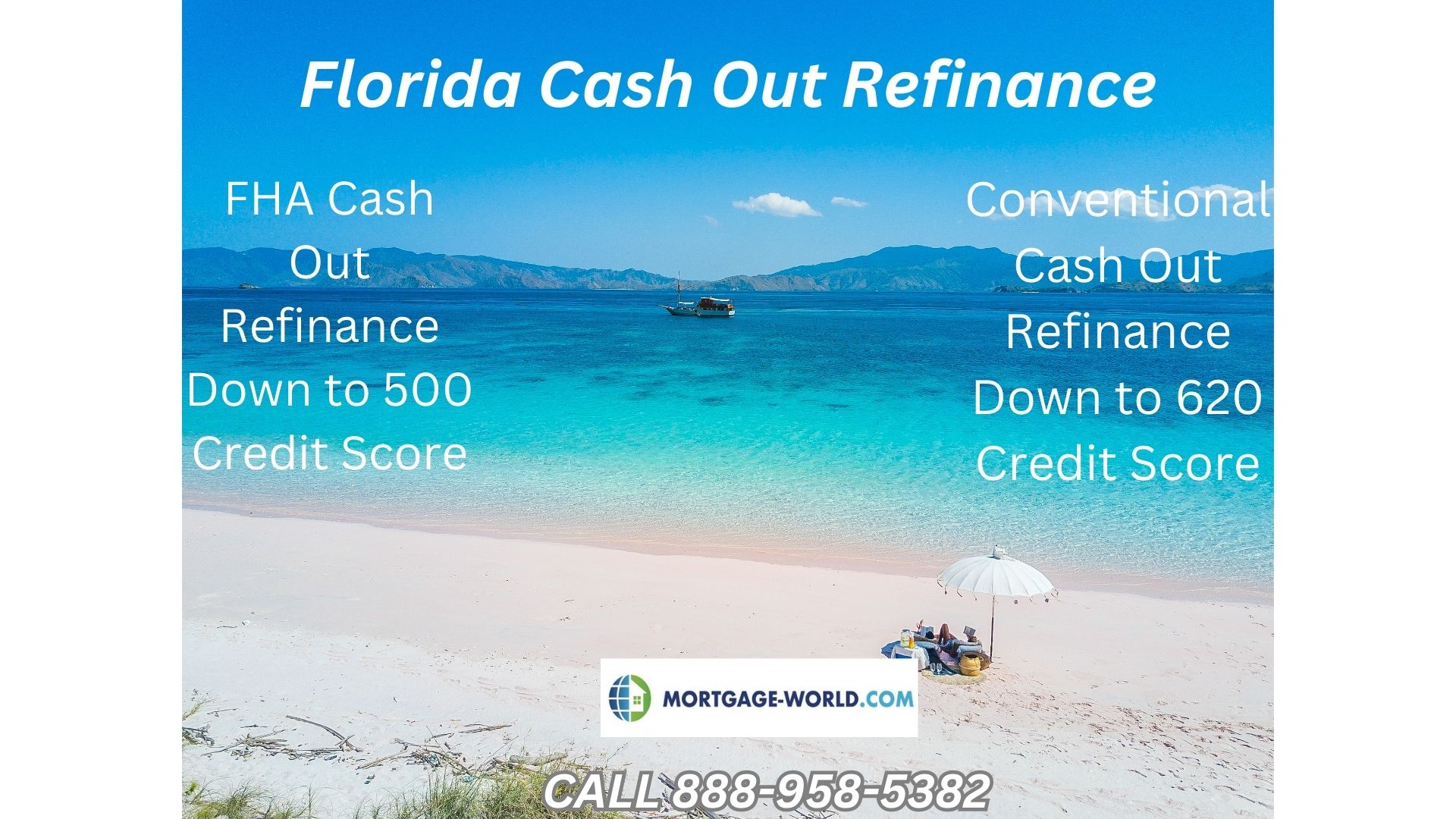

Credit Score: Your credit score plays a pivotal role in the approval process. Lenders typically require a credit score of at least 620 for conventional loans, although some lenders may have stricter requirements. For an FHA loan, credit scores down to 500 are acceptable.

Loan-to-Value Ratio: The loan-to-value (LTV) ratio is crucial. Most lenders cap the LTV ratio at 80-85%, meaning you can't borrow more than 80-85% of your home's appraised value. This safeguards lenders against excessive risk.

Debt-to-Income Ratio: Lenders assess your debt-to-income (DTI) ratio to ensure you can handle the additional debt. Typically, a DTI ratio of 43% or less is preferred.

Employment and Income Stability: Lenders want to see a stable source of income. A consistent job history and steady income can positively influence your application.

Preparing to Apply

Before applying for a mortgage cash out refinance, it's wise to prepare thoroughly.

Review Your Credit: Check your credit report for errors and work on improving your credit score if necessary.

Calculate Your Home's Equity: Understanding your home's equity is crucial. Lenders will need this information during the application process.

Steps to Qualify: The process of qualifying for a mortgage cash out refinance involves several steps:

- Application Process: Submit an application to your chosen lender, providing all necessary documents.

- Appraisal and Underwriting: Your home will be appraised to determine its current value. The underwriting process assesses your eligibility.

- Closing: Once approved, you'll go through the closing process, where the loan is funded.

Advantages of Cash-Out Refinancing

Lower Interest Rates: One of the primary advantages of cash out refinancing is the potential to secure a lower interest rate on your mortgage. If current interest rates are lower than what you initially agreed to, you can refinance at the new, lower rate, potentially reducing your monthly mortgage payments.

Debt Consolidation: Cash out refinancing allows you to consolidate high-interest debts, such as credit card balances or personal loans, into a single, lower-interest mortgage. This can make managing your finances simpler and save you money on interest payments.

Home Improvement: Many homeowners use the cash from a refinance to make home improvements or renovations. These improvements can increase the value of your home, making it a sound investment for the future.

Access to Cash: If you have a significant amount of equity in your home, cash out refinancing provides a way to access that cash. This can be helpful for major expenses like medical bills, education, or other large financial needs.

Tax Benefits: In many cases, the interest on your mortgage is tax-deductible. By consolidating high-interest debts into your mortgage, you may increase your potential tax deductions.

Fixed-Rate Option: Cash out refinancing allows you to switch from an adjustable-rate mortgage (ARM) to a fixed-rate mortgage. This can provide stability and protection from rising interest rates.

Reduced Monthly Payments: By extending the loan term or securing a lower interest rate, cash out refinancing can lead to reduced monthly mortgage payments, improving your monthly cash flow.

Investment Opportunities: The cash from a cash out refinance can be invested in opportunities that have the potential to yield higher returns than the interest on your mortgage, such as starting a business or investing in stocks.

Emergency Funds: Having access to cash through a cash out refinance can serve as an emergency fund, providing a financial safety net during unexpected circumstances.

Enhanced Credit Profile: Paying off high-interest debts through cash out refinancing can improve your credit profile, making it easier to secure credit in the future.

Risks of a Mortgage Cash Out Refinance

Increased Mortgage Debt: One of the primary risks of cash out refinancing is that it increases your mortgage debt. When you take out additional cash, your mortgage balance goes up. This can result in higher monthly payments and a more extended loan term, potentially leading to paying more interest over the life of the loan.

Risk of Foreclosure: Increasing your mortgage balance means risking your home if you can't make the payments. If your financial situation deteriorates, you might be at risk of foreclosure, as your home serves as collateral for the loan.

Closing Costs: Cash out refinancing involves closing costs, just like any other mortgage. These costs can be substantial and might outweigh the benefits of the refinance, especially if you don't stay in the home for an extended period.

Higher Interest Rates: If you refinance when interest rates are higher than your current rate, you might end up with a more expensive mortgage. Be cautious about timing your cash out refinance to coincide with favorable interest rates.

Loss of Home Equity: By taking cash out of your home, you reduce the equity you've built over time. This could limit your options for future home-related financial strategies, such as selling your home or using it as collateral for other loans.

Extended Loan Term: Extending the loan term to reduce monthly payments can lead to higher overall interest costs. You might end up paying more for your home in the long run.

Increased Risk of Over-Borrowing: Having access to a significant amount of cash through a cash out refinance can tempt you to overspend or take on more debt than you can handle.

Reduced Flexibility: Once you've used your home equity for cash out refinancing, you have fewer options for leveraging your home for other financial needs.

Potential Negative Impact on Credit: Failing to manage the additional debt from cash out refinancing can negatively impact your credit score, making it more challenging to secure credit in the future.

Market Fluctuations: Your home's value is subject to market fluctuations. If the housing market declines, you might owe more on your mortgage than your home is worth, which can pose financial challenges.

Alternatives to a Mortgage Cash Out Refinance

Home Equity Line of Credit (HELOC): A HELOC is a revolving line of credit that allows you to borrow against the equity in your home. It's a flexible option that lets you access funds when needed and pay them back as you go. Interest rates on HELOCs are often lower than credit cards, making them suitable for home improvements or other expenses.

Home Equity Loan: Unlike a HELOC, a home equity loan provides a lump sum of money upfront, which you repay over time with a fixed interest rate. This is a good choice if you have a specific project with a defined cost, like a home renovation.

Personal Loan: If you don't want to use your home as collateral, a personal loan is an unsecured option. The interest rates on personal loans can be higher than those for home equity options, but they don't put your home at risk.

Credit Cards: For smaller expenses, credit cards can be a quick and convenient option. However, they typically have higher interest rates than other financing methods. It's essential to manage your credit card debt wisely.

Savings or Emergency Fund: If the expense is manageable and not urgent, consider using your savings or emergency fund. This avoids taking on additional debt and interest payments.

Government Assistance Programs: Some government programs provide financial assistance for specific purposes, such as energy-efficient home improvements or down payments on first-time home purchases. Research available programs in your area.

Sell Assets: If you have non-essential assets like a second car, collectibles, or investments, selling them can provide the funds you need without borrowing against your home.

Borrow from Family or Friends: If you have a trusted network of family or friends, consider asking for a loan. Be sure to formalize the arrangement with clear terms and a written agreement to avoid potential misunderstandings.

Second Mortgage: If you want to keep your existing mortgage as is, you can explore a second mortgage, which is an additional loan secured by your home. This option allows you to tap into your home's equity without refinancing the primary mortgage.

Cash Out Refinance with a Shorter Term: Instead of extending your mortgage term, you can opt for a cash out refinance with a shorter term. This approach may result in higher monthly payments but can save you on overall interest costs.

Conclusion

Qualifying for a mortgage cash out refinance may require some effort, but it can provide significant financial benefits. It's essential to assess your financial situation, understand the requirements, and carefully weigh the advantages and disadvantages before proceeding.

Frequently Asked Questions (FAQs)

Q. What are the primary reasons people consider cash out refinancing?

A. Cash out refinancing is commonly used for home improvements, debt consolidation, and major expenses like education or medical bills.

Q. Can I qualify for a cash out refinance if I have a low credit score?

A. While it can be more challenging, some lenders offer options for those with lower credit scores. FHA allows a minimum credit score of 500 to qualify.

Q. How long does the cash out refinance process typically take?

A. The process usually takes 30 days, but it can vary based on individual circumstances and lender efficiency.

Q. Are there tax implications associated with cash out refinancing?

A. Consult with a tax professional, as there may be tax consequences depending on how you use the cash from your refinance.

Q. Can I do multiple cash out refinances on my home?

A. It's possible but may be subject to lender restrictions and approval criteria.

Call us 888-958-5382

www.MORTGAGE-WORLD.com LLC is an online mortgage company specializing in FHA loans for first time home buyers.

We look forward to working with you.

Recent Articles

-

Mortgage Rates August 5

Aug 05, 24 04:10 PM

Mortgage Rates August 5, 2024. Rates have gone down recently. Lower rates equals lower mortgage payment. -

Mortgage Rates August 5 2024

Aug 05, 24 03:55 PM

Mortgage Rates August 5 2024 -

Today's FHA Rates 5.00% & 5.875% Conventional Minimum 700 Credit Score

Aug 05, 24 03:48 PM

Today’s historically low 30 year fixed interest rates make now the perfect time to purchase a new home or refinance To be approved at the lowest mortgage rates, you do not need to have the highest cre…

Call Now, Our Staff is Available!

800.516.9166