www.Mortgage-World.com LLC

FHA minimum credit score to buy a house is 500.

New FHA policy requires a minimum credit of 500 to buy a home or refinance. In the old days FHA did not require a minimum score. These changes went in to effect in 2010.

To buy a home you will need a minimum credit score of 500.

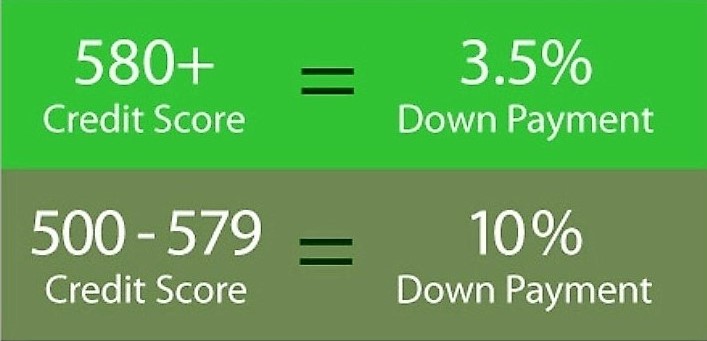

Borrowers with scores above 580 require a 3.5% down payment. The funds can be a gift from a family member and a 6% seller's concession is allowed.

If you have credit scores below 580 new FHA changes require a 10% down payment. The funds can be a gift from a family member and a 6% seller's concession is allowed.

To refinance your mortgage you need a minimum 500 credit score.

Borrowers with a minimum credit score above 500 can refinance up to a 97.5% loan-to-value on a rate and term refinance. And up to 80% cash out refinance with a credit score above 500.

Most lenders require a minimum credit score of 640 for a FHA loan.

Whether you're planing to buy your first home, refinance, lower your monthly payments, buy a second home, consolidate debt or get pre-approved for a mortgage. A perfect credit score is not needed for an FHA loan approval.

In fact, even if you have had credit problems, such as a bankruptcy, it's easier for you to qualify for an FHA loan than a for a conventional loan. Credit scores down to 500 are accepted if there are compensating factors that offset the credit risk.

Call us 888.958.4228

Call us 888-958-5382

www.MORTGAGE-WORLD.com LLC is an online mortgage company specializing in FHA loans for first time home buyers.

We look forward to working with you.

FHA Credit Score needed to buy

a house or refinance

FHA loan requirements new borrowers with less than a 580 credit score will be required to put down at least 10%

FHA requires a minimum credit score of 500 to buy a home or refinance

Bankruptcy

Chapter 7 Bankruptcy at least two years must have elapsed since the discharge date

Foreclosure

Foreclosure must have been resolved for at least 3 years

Government loan: Seasoning is determined by the date the claim was paid

Loans other than Government: Seasoning is determined by the date of sale the lender sold the property

Short Sale

FHA guidelines requires three year past from the date of sale of the property

What documentation will I need?

- W2's or Personal tax returns for 2 years

- Current pay stubs for the past month

- Bank statements for last 2 months (all pages)

- Clear copy of Driver’s License (front and back)

- Clear copy of SS card (front and back)

Call Now, Our Staff is Available

888-958-4228

Recent Articles

-

Mortgage Rates August 5

Aug 05, 24 04:10 PM

Mortgage Rates August 5, 2024. Rates have gone down recently. Lower rates equals lower mortgage payment. -

Mortgage Rates August 5 2024

Aug 05, 24 03:55 PM

Mortgage Rates August 5 2024 -

Today's FHA Rates 5.00% & 5.875% Conventional Minimum 700 Credit Score

Aug 05, 24 03:48 PM

Today’s historically low 30 year fixed interest rates make now the perfect time to purchase a new home or refinance To be approved at the lowest mortgage rates, you do not need to have the highest cre…

Call Now, Our Staff is Available!

800.516.9166