FHA loan requirements 2024

FHA loan requirements 2024 Purchase or Refinance?

FHA Loan Requirements 2024

FHA loan requirements 2024 - minimum credit score is 500 to buy a house or refinance.

New FHA policy requires a minimum credit score of 500 to buy a house or refinance. Borrowers with a credit score above 500 are eligible for an FHA loan.

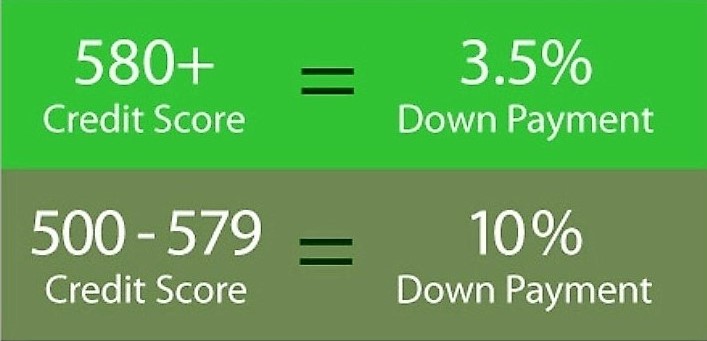

New borrowers will now be required to have a minimum credit score of 580 to qualify for FHA 3.5% down payment. New borrowers with less than a 580 credit score will be required to put at least 10% down payment.

The FHA has updated the combination of credit score and down payments for new borrowers:

- New borrowers will now be required to have a minimum credit score of 580 to qualify for FHA's 3.5% down payment program

- New borrowers with less than a 580 credit score will be required to put down at least 10% down paymnet

Refinance

Borrowers with a score above 500 can refinance up to a 97.5% loan-to-value on a rate and term refinance. And up to 80% cash out refinance with a credit score above 500.

No credit history

Three lines of credit are necessary to apply for an FHA loan. However, in the event a borrower does not have sufficient credit on their credit report the FHA will allow substitute forms. FHA allows minimum alternative trade lines if you have no credit scores.

Late payments

During an underwriter analysis of borrower credit, the overall pattern of credit behavior is being reviewed rather than isolated cases of slow payments. If a good payment pattern has been maintained, regardless of a specific period of financial difficulty preceded it, the borrower may escape disqualification.

Collection accounts

FHA does not require collection accounts to be paid off as a condition of mortgage approval. However, FHA does recognize that collection efforts by the creditor for unpaid collections could affect the borrower’s ability to repay the mortgage.

- If evidence of a payment arrangement is not available, the lender must calculate the monthly payment using 5% of the outstanding balance of each collection, and include the monthly payment in the borrower’s debt-to-income ratio.

- FHA loan requirements 2024

Chapter 7 Bankruptcy

At least two years must have elapsed since the discharge date of the borrower and / or spouse's Chapter 7 Bankruptcy, according to FHA guidelines. This is not to be confused with the bankruptcy filing date. A full explanation will be required with the loan application. In order to qualify for an FHA loan, the borrower must qualify financially, have re-established good credit, and have a stable job.

Chapter 13 bankruptcy

FHA will consider approving a borrower who is still paying on a Chapter 13 Bankruptcy if those payments have been satisfactorily made and verified for a period of one year. The court trustee's written approval will also be needed in order to proceed with the loan. The borrower will have to give a full explanation of the bankruptcy with the loan application and must also have re-established good credit, qualify financially and have good job stability.

- FHA loan requirements 2024

- FHA minimum credit score is 500

Call us 888.958.4228

FHA purchase FHA refinance FHA 203k loan FHA cash out $100 down loan

FHA loan requirements - FHA loan limits - FHA loans - FHA Streamline

www.MORTGAGE-WORLD.com LLC is an online mortgage company specializing in FHA loans for first time home buyers.

We look forward to working with you.

Call us 888-958-5382

www.MORTGAGE-WORLD.com LLC is an online mortgage company specializing in FHA loans for first time home buyers.

We look forward to working with you.

Recent Articles

-

Mortgage Rates August 5

Aug 05, 24 04:10 PM

Mortgage Rates August 5, 2024. Rates have gone down recently. Lower rates equals lower mortgage payment. -

Mortgage Rates August 5 2024

Aug 05, 24 03:55 PM

Mortgage Rates August 5 2024 -

Today's FHA Rates 5.00% & 5.875% Conventional Minimum 700 Credit Score

Aug 05, 24 03:48 PM

Today’s historically low 30 year fixed interest rates make now the perfect time to purchase a new home or refinance To be approved at the lowest mortgage rates, you do not need to have the highest cre…

Call Now, Our Staff is Available!

800.516.9166

Call 888.958.4228

Recent Articles

-

Mortgage Rates August 5

Aug 05, 24 04:10 PM

Mortgage Rates August 5, 2024. Rates have gone down recently. Lower rates equals lower mortgage payment. -

Mortgage Rates August 5 2024

Aug 05, 24 03:55 PM

Mortgage Rates August 5 2024 -

Today's FHA Rates 5.00% & 5.875% Conventional Minimum 700 Credit Score

Aug 05, 24 03:48 PM

Today’s historically low 30 year fixed interest rates make now the perfect time to purchase a new home or refinance To be approved at the lowest mortgage rates, you do not need to have the highest cre…