First Time Home Buyer New Jersey

First time home buyer New Jersey

First time home buyer New Jersey - Effective for all FHA programs. There are no documentation or letter of explanation requirements for loans with collection accounts or judgments run through Fannie Mae that receive an Approve/Eligible despite the presence of collection accounts or charge-offs.

- FHA does not require collection accounts to be paid off as a condition of mortgage approval

- FHA does not require charge-offs to be paid off as a condition of mortgage approval

- FHA requires judgments to be paid off before the mortgage loan is eligible for closing

An exception to the payoff of a court ordered judgment may be made if the borrower has an agreement with the creditor to make regular and timely payments.

The FHA has taken the following step:

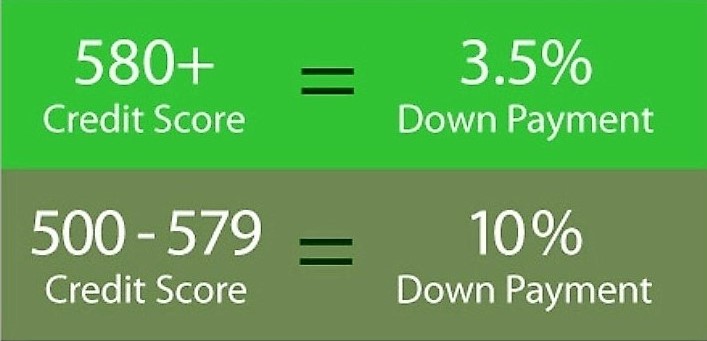

- Update the combination of credit score and down payments for first time home buyer

- New borrowers will now be required to have a minimum credit score of 580 to qualify for FHA's 3.5% down payment program

- New borrowers with less than a 580 credit score will be required to put down at least 10%

- Credit score needed buy house is 500

FHA increased the annual MIP requirements:

- revision to the period for assessing the annual MIP

- removal of the exemption from the annual MIP for loans with terms of 15 years or less and LTVs of less than or equal to 78 percent at origination

- increase in the annual MIP for mortgages with terms less than or equal to 15 years and LTV ratios less than or equal to 78 percent at origination

- rescinds the automatic cancellation of the annual MIP collection

For any mortgage with an loan-to-value greater than 90% FHA will assess the annual mortgage insurance premium until the end of the mortgage (life-of-the-loan).

For all mortgages with less than or equal to 90% loan-to-value the annual mortgage insurance premium will be assessed for the first 11 years of the mortgage term.

Today’s historically low interest rates make now the perfect time to purchase a new home or refinance.

First time home buyer New Jersey

www.Mortgage-World.com LLC is an online mortgage company specializing in FHA loans for first time home buyers. To buy a home with 3.5% down payment and a minimum credit score of 580 using an FHA loan.

Call us 888-958-5382

www.MORTGAGE-WORLD.com LLC is an online mortgage company specializing in FHA loans for first time home buyers.

Call us 888.958.5382

FHA loan requirements - FHA loan limits - FHA loans - FHA purchase

www.MORTGAGE-WORLD.com LLC is an online mortgage company specializing in FHA loans for first time home buyers.

We look forward to working with you.

We look forward to working with you.

Recent Articles

-

Mortgage Rates August 5

Aug 05, 24 04:10 PM

Mortgage Rates August 5, 2024. Rates have gone down recently. Lower rates equals lower mortgage payment. -

Mortgage Rates August 5 2024

Aug 05, 24 03:55 PM

Mortgage Rates August 5 2024 -

Today's FHA Rates 5.00% & 5.875% Conventional Minimum 700 Credit Score

Aug 05, 24 03:48 PM

Today’s historically low 30 year fixed interest rates make now the perfect time to purchase a new home or refinance To be approved at the lowest mortgage rates, you do not need to have the highest cre…

Call Now, Our Staff is Available!

800.516.9166

Call 888-958-5382

Recent Articles

-

Mortgage Rates August 5

Aug 05, 24 04:10 PM

Mortgage Rates August 5, 2024. Rates have gone down recently. Lower rates equals lower mortgage payment. -

Mortgage Rates August 5 2024

Aug 05, 24 03:55 PM

Mortgage Rates August 5 2024 -

Today's FHA Rates 5.00% & 5.875% Conventional Minimum 700 Credit Score

Aug 05, 24 03:48 PM

Today’s historically low 30 year fixed interest rates make now the perfect time to purchase a new home or refinance To be approved at the lowest mortgage rates, you do not need to have the highest cre…