FHA credit score needed to buy a house 2024

FHA credit score needed to buy a house 2024

FHA credit score needed to buy a house 2024

FHA after bankruptcy FHA after foreclosure FHA after short sale

FHA credit score needed to buy a house is 500 minimum.

FHA announced a set of policy changes to strengthen the FHA. The changes announced are the latest in a series of changes enacted in order to better position the FHA to manage its risk while continuing to support the nation’s housing market recovery.

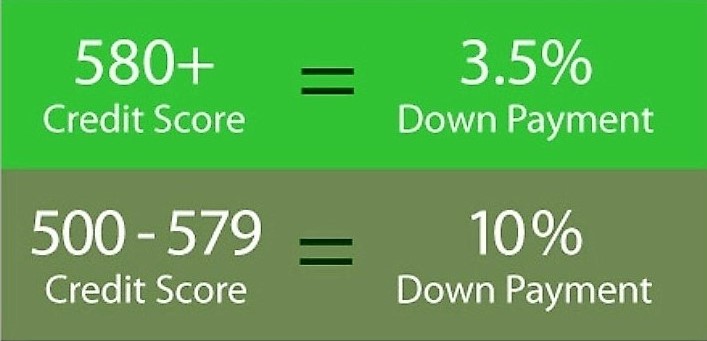

The FHA has updated the combination of credit score and down payments for new borrowers:

- 580 credit score to qualify for FHA's 3.5% down payment

- Below 580 credit score 10% down payment

- 500 minimum credit score

- No credit scores are allowed

No credit history

Three lines of credit are necessary to apply for an FHA loan. However, in the event a borrower does not have sufficient credit on their credit report the FHA will allow substitute forms. FHA allows minimum alternative trade lines if you have no credit scores.

Late payments

During an underwriter analysis of borrower credit, the overall pattern of credit behavior is being reviewed rather than isolated cases of slow payments. If a good payment pattern has been maintained, regardless of a specific period of financial difficulty preceded it, the borrower may escape disqualification.

Collection accounts

FHA does not require collection accounts to be paid off as a condition of mortgage approval. However, FHA does recognize that collection efforts by the creditor for unpaid collections could affect the borrower’s ability to repay the mortgage.

- If evidence of a payment arrangement is not available, the lender must calculate the monthly payment using 5% of the outstanding balance of each collection, and include the monthly payment in the borrower’s debt-to-income ratio.

- FHA credit score needed to buy a house

Debt to income ratio to buy a house

Debt to income ratios are the calculations underwriters use to determine whether a borrower can qualify for a mortgage. They are used to determine if you have the capacity to repay your mortgage.

- FHA DTI ratio is 45%/55% with credit score above 620

- FHA DTI ratio is 31%/43% with credit score below 620

There are two calculations. The first or Front Ratio is your housing expense-to-income ratio. This is your proposed mortgage payment (principle, interest, taxes, mortgage insurance, and home owners insurance) divided by your gross monthly income.

The second or Back Ratio is your total monthly obligations-to-income ratio. This is your gross monthly payment including Mortgage PITI divided by your gross monthly income.

FHA loans include a maximum debt to income ratio. When a borrower applies for a mortgage, they are required to disclose all debts, open lines of credit, and all possible approved sources of regular income. Using this data, the lender calculates the borrower's debt-to-income ratio.

Call us 888.958.4228

FHA purchase FHA refinance FHA 203k loan FHA cash out $100 down loan

FHA loan requirements - FHA loan limits - FHA loans - FHA Streamline

www.MORTGAGE-WORLD.com LLC is an online mortgage company specializing in FHA loans for first time home buyers.

We look forward to working with you.

Call us 888-958-5382

www.MORTGAGE-WORLD.com LLC is an online mortgage company specializing in FHA loans for first time home buyers.

We look forward to working with you.

FHA credit score needed to buy a house 2023

Recent Articles

-

Mortgage Rates August 5

Aug 05, 24 04:10 PM

Mortgage Rates August 5, 2024. Rates have gone down recently. Lower rates equals lower mortgage payment. -

Mortgage Rates August 5 2024

Aug 05, 24 03:55 PM

Mortgage Rates August 5 2024 -

Today's FHA Rates 5.00% & 5.875% Conventional Minimum 700 Credit Score

Aug 05, 24 03:48 PM

Today’s historically low 30 year fixed interest rates make now the perfect time to purchase a new home or refinance To be approved at the lowest mortgage rates, you do not need to have the highest cre…

Call Now, Our Staff is Available!

800.516.9166

Call 888.958.4228

Recent Articles

-

Mortgage Rates August 5

Aug 05, 24 04:10 PM

Mortgage Rates August 5, 2024. Rates have gone down recently. Lower rates equals lower mortgage payment. -

Mortgage Rates August 5 2024

Aug 05, 24 03:55 PM

Mortgage Rates August 5 2024 -

Today's FHA Rates 5.00% & 5.875% Conventional Minimum 700 Credit Score

Aug 05, 24 03:48 PM

Today’s historically low 30 year fixed interest rates make now the perfect time to purchase a new home or refinance To be approved at the lowest mortgage rates, you do not need to have the highest cre…